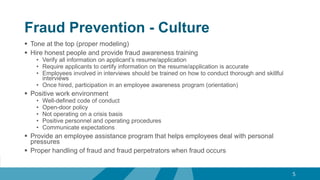

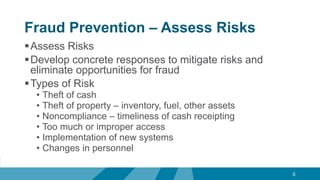

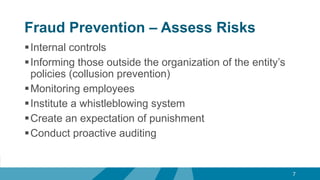

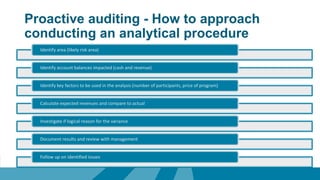

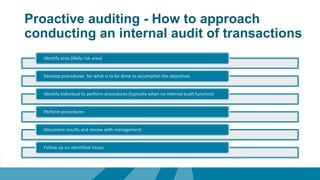

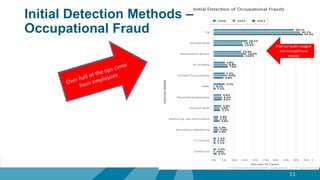

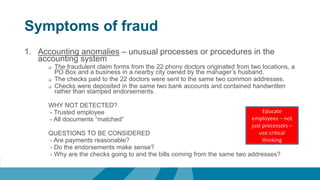

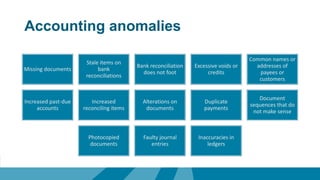

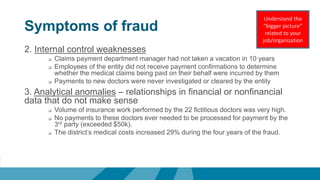

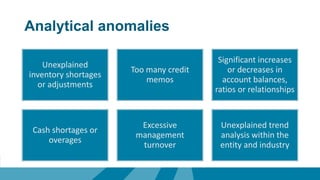

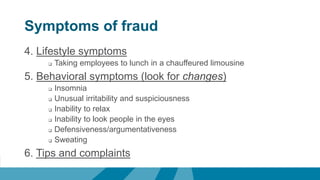

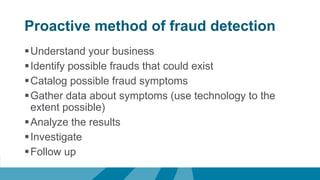

This document discusses proactive measures for preventing and detecting fraud. It outlines the fraud triangle and common fraud schemes by industry. It then discusses establishing a culture of fraud prevention through hiring practices, training, and policies. It also recommends assessing fraud risks and implementing internal controls. Detection methods include monitoring for accounting anomalies, internal control weaknesses, analytical anomalies, lifestyle changes, and behavioral symptoms. The document advocates taking a proactive approach to fraud auditing by understanding risks and symptoms and continuously analyzing data.