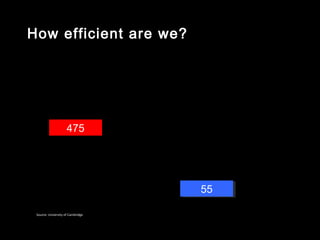

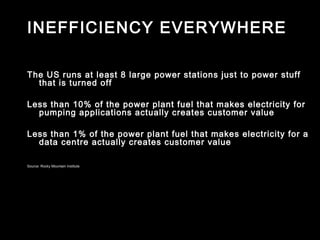

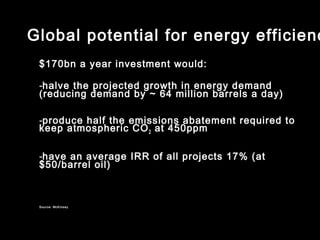

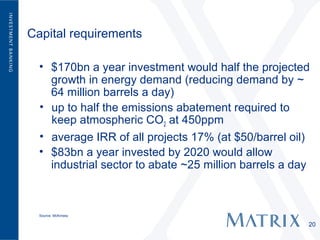

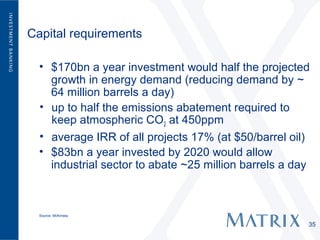

1. There is large untapped potential for improving energy efficiency globally through investments that have average returns of 17% and could halve projected growth in energy demand.

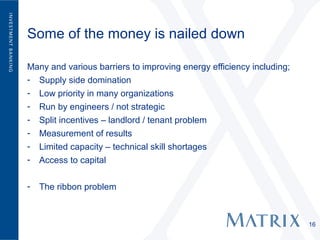

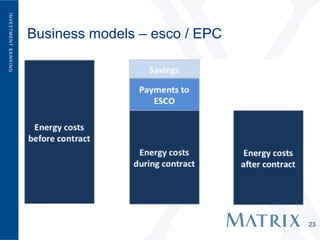

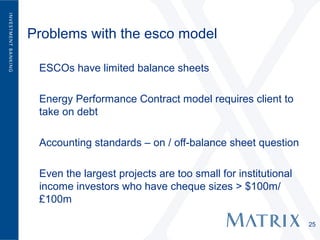

2. However, many barriers currently prevent these efficiency opportunities from being realized at scale, including low prioritization, split incentives between parties, and lack of appropriate business models that can attract large institutional investors.

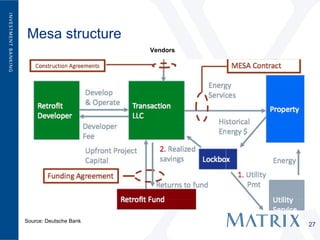

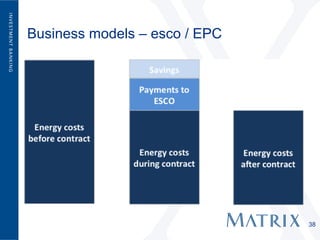

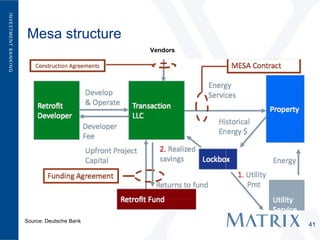

3. Two emerging business models, Managed Energy Service Agreements and transaction vehicles, aim to overcome these barriers by structuring large projects that allow institutional investors to invest significant capital at scale.