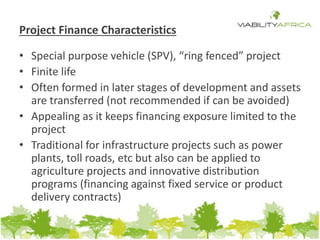

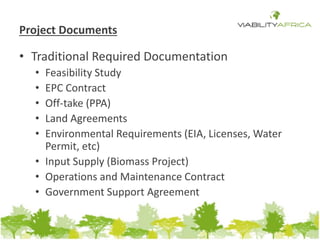

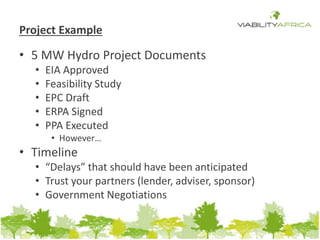

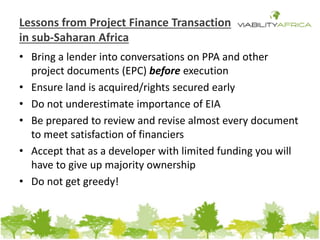

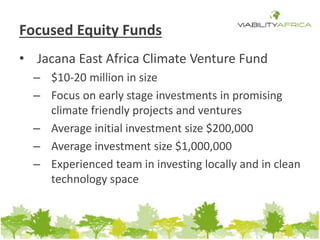

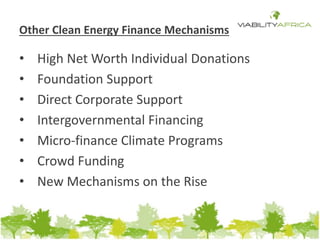

Viability Africa, LLC aims to lead the development and financial advisory sectors for clean technology projects in East Africa, focusing on sustainability and investment viability. The presentation covers critical components of project finance, including funding sources, project management, and the characteristics of successful transactions, emphasizing the importance of early land acquisition and thorough documentation. It also addresses the challenges faced by small and medium-sized businesses in accessing finance and explores various funding options and negotiation strategies.