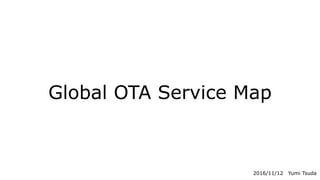

The document provides a map of global online travel agencies (OTAs) including basic OTAs, comparing sites, and neo OTAs. It shows the growth trends of different types of OTAs over time in the US/Europe and ASEAN countries. Key details include the oldest and largest OTAs, major exits through IPOs and acquisitions, and the relatively fewer but growing number of OTAs launching in ASEAN countries in recent years with some receiving funding.

![2

Global Service Map

<Other Independents>

(Comparison) [1.9M]

(Neo OTA) [52.7M]

<ASEAN Biggs>

(Basic OTA) [8.4M]

(Basic OTA) [6.8M]

(Basic OTA) [1.7M]

(Basic OTA) [4.6M]

(Hotel OTA) [5.1M]

(Basic OTA) [11.8M]

(Hotel Booking) [129.4M]

(Comparison) [12.9M]

(Neo OTA) [10.3M]

(Tour OTA) [6.9M]

(Comparison) [19.1M]

(Booking Management SaaS)

Oldest

Brands

Expedia Group

(by IAC)

IPO

(Basic OTA) [30.9M]

(Hotel OTA) [291.3M]

(Hotel OTA) [32.1M] @SG

(Comparison) [31.6M]

(Booking Management SaaS)

Huge

Traffic

Priceline Group IPO

(Neo OTA) [884K]

(Basic OTA) [43.9M]

(Tour OTA) [236K]

Biggest in

China

Ctrip Group

(Tour OTA) [7.8M]

IPO

IPO

(Basic OTA) [23.3M]

(Basic OTA) [6.0M]

(Bus OTA) [7.0M]

(Comparison) [1.0M]

@Thailand

Has taken

India

MakeMyTrip Group

(Hotel OTA) [8.8M]

IPO

Invests

[]: Estimated monthly visits](https://image.slidesharecdn.com/otaserivemap20161112-161112151753/85/Global-OTA-Service-Map-2-320.jpg)

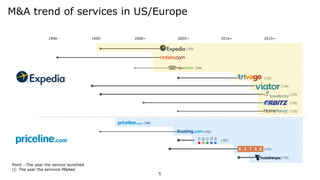

![9

Funded Services in ASEAN

Country Founded Service Raised to date Major Round Major Investors

Singapore 2005 Flight Booking $60.5M 2015, Venture

2013, Series C

Crescent Group, Tiger

Global Management

Indonesia 2015 Branded Hotels $5.5M 2016, Pre-Series A Convergence, Cyber

Agent

Indonesia 2012 Hotel Booking $3M 2012, Venture Recruit (JV)

Vietnam 2014 Hotel Booking (Official partner of

Booking.com)

$3M 2016, Series A F&H (SG)

Indonesia 2015 Price Negotiable Hotel Booking $2M 2015, Seed Gobi, SURYA SEMESTA

INTERNUSA

Singapore 2015 Branded Hotels $1M 2015, Seed Ooredo, Rocket

Internet

Myanmar 2015 Flight Booking $1M 2016, Series A BOD Tech

Indonesia 2014 Tour Booking $1M 2015, Series A Gobi, East Ventures

Indonesia 2012 Flight Booking Undisclosed 2013, Series A Global Founders

Capital,

East Ventures

Myanmar 2011 Hotel & Flight Booking Undisclosed 2015, Venture Beenext

Malaysia 2002 [to B] OEM of Booking Service. Undisclosed 2015, Venture GGV, DMP

Funded services are still very few too.](https://image.slidesharecdn.com/otaserivemap20161112-161112151753/85/Global-OTA-Service-Map-9-320.jpg)