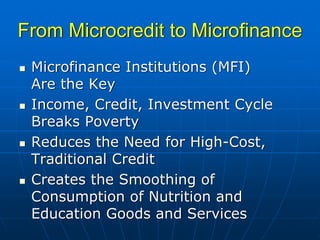

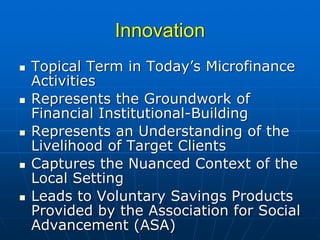

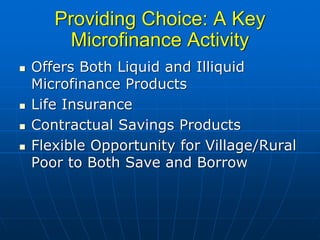

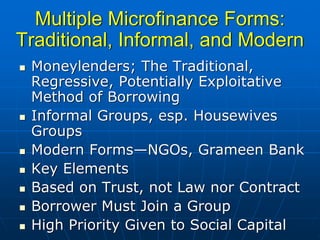

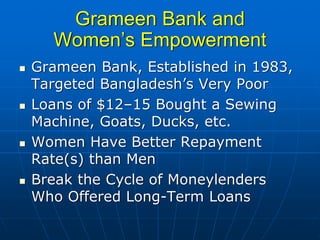

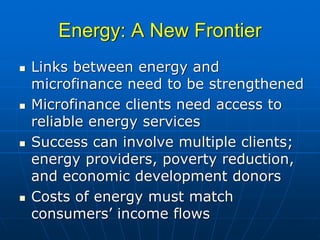

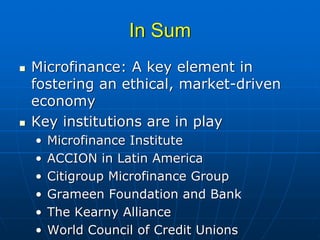

The document discusses the role of microfinance in supporting rural marketing strategies, emphasizing that microfinance institutions are crucial for alleviating poverty and fostering economic development in rural areas. It highlights the need for innovative marketing approaches tailored to rural contexts, including product availability, affordability, acceptability, and awareness, as well as the importance of consumer education and trust-based borrower relationships. Furthermore, it explores the collaboration between multinational corporations and NGOs in extending microfinance initiatives and improving rural distribution networks to reach impoverished populations.