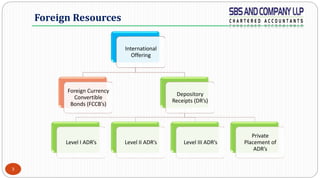

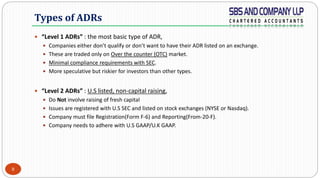

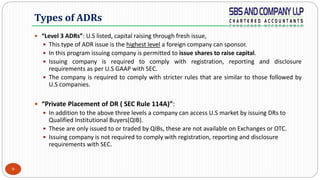

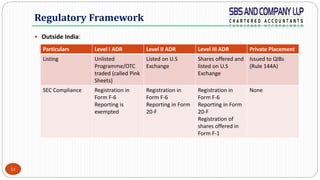

The document outlines the concept and framework of Depository Receipts (DRs), particularly focusing on American Depository Receipts (ADRs), their types, and regulatory frameworks within and outside India. It distinguishes between sponsored and unsponsored ADRs, detailing the process of issuance and the parties involved, along with the required approvals and documents. Additionally, it highlights risks associated with investing in ADRs, such as political risk and exchange rate fluctuations.