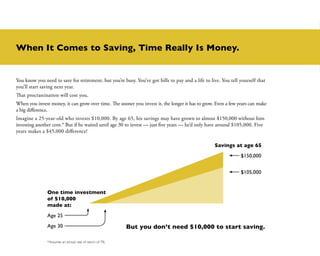

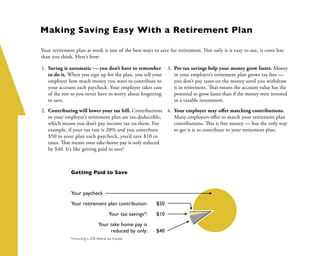

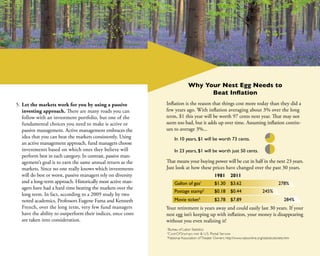

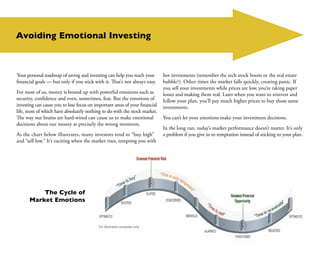

Retirement planning is important because Social Security alone will not provide enough income for a comfortable retirement. It is essential to start saving as early as possible because small monthly contributions can grow significantly over time with compound interest. Even saving a few hundred dollars per month can result in hundreds of thousands of savings by retirement. Employer retirement plans make saving automatic and contribute to lower taxes, and some employers offer matching contributions. For investments to beat inflation, a long-term passive approach with diversified global funds is recommended over trying to time the market or relying solely on active fund managers. Emotions can interfere with sticking to a savings plan, so it is best to develop a personal roadmap and avoid making decisions based on rising and falling stock