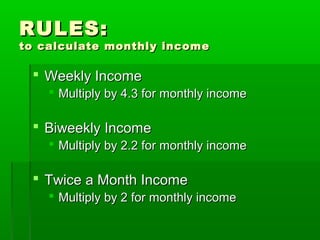

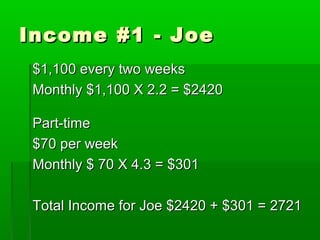

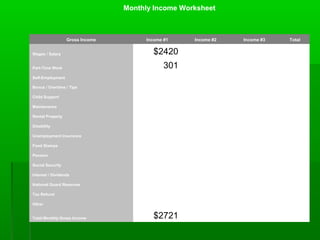

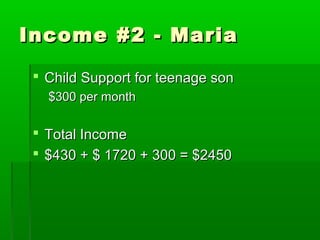

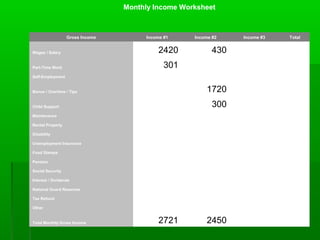

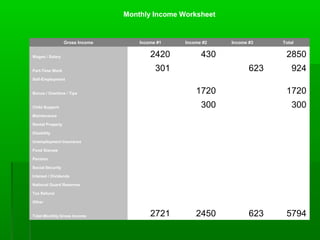

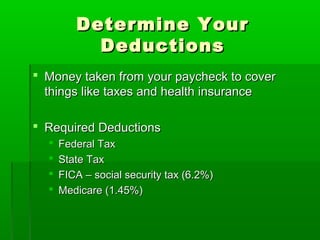

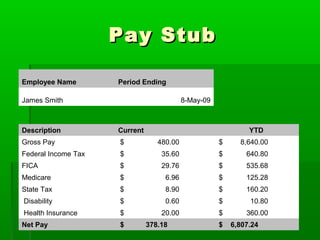

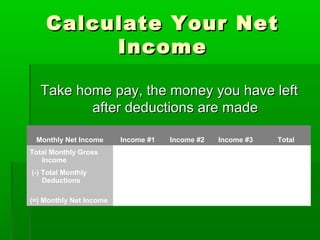

This document provides an overview of the first class in a series of 6 classes on personal finance called "MONEY MATTERS". The class covers calculating monthly income, determining deductions, and preparing a budget. Key points include listing sources of income, applying rules to calculate monthly amounts, identifying required and voluntary deductions on a pay stub, and using income and expense information to create a budget and financial plan. The class aims to help participants better understand and take control of their financial situation.