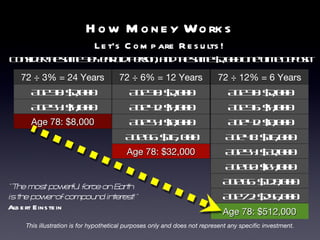

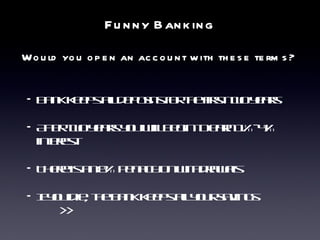

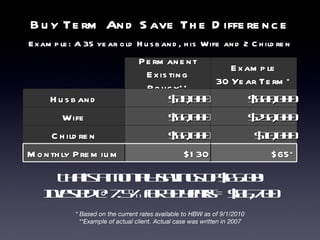

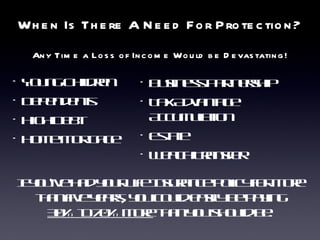

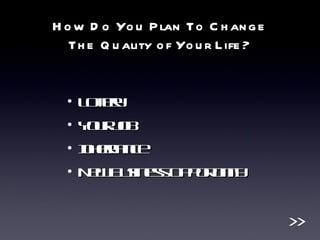

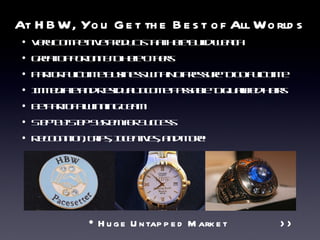

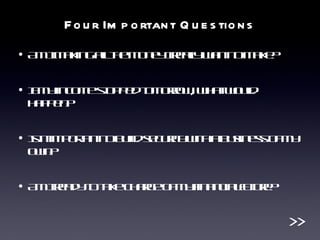

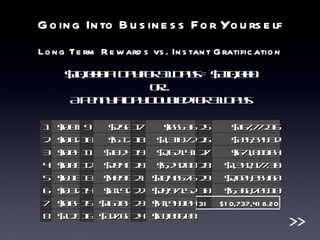

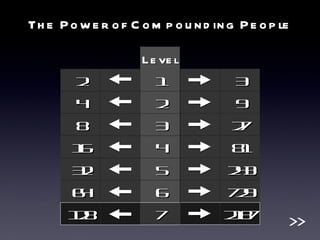

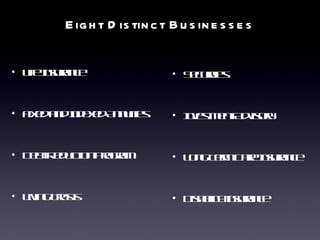

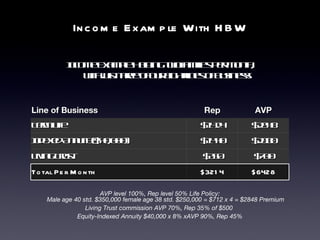

This document summarizes a marketing presentation for a financial services company called HBW. It promotes HBW's products like life insurance, annuities, and trusts which help build wealth. It highlights the growth opportunity in the industry given an aging population. Representatives can earn income from commissions on sales and build a business part or full-time with competitive products and support.