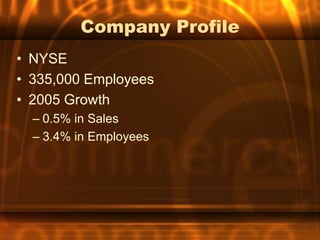

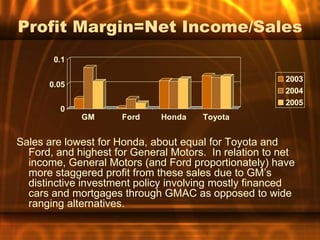

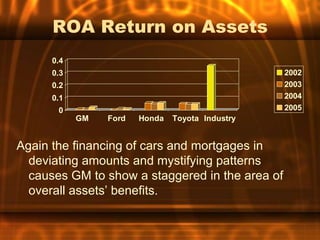

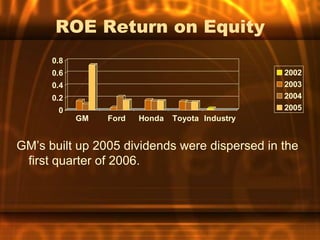

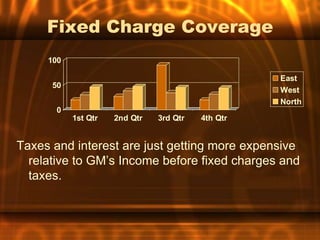

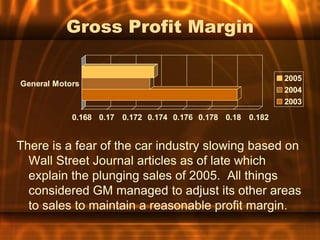

General Motors is a large automaker with over 335,000 employees. It produces vehicles under brands such as Buick, Cadillac, Chevrolet, and GMC. While GM's sales grew modestly in 2005, its employee numbers increased by 3.4%. The company has various subsidiaries and inventory holdings around the world. GM's profit margins have historically been lower than competitors like Toyota and Honda due to its large investments in financing operations through GMAC. Going forward, GM is seeking to improve its financial position by selling interests in GMAC and developing more hybrid vehicles.