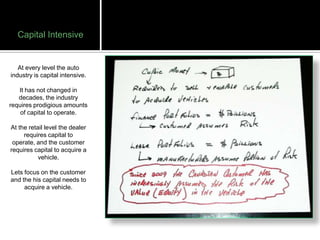

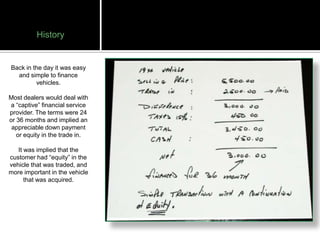

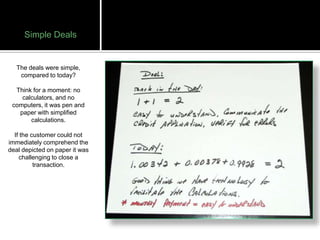

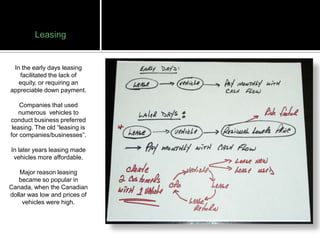

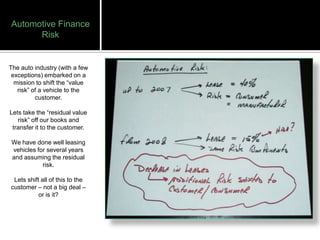

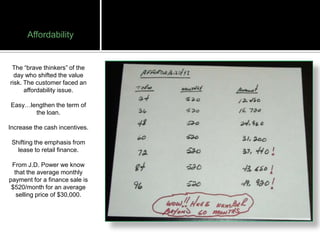

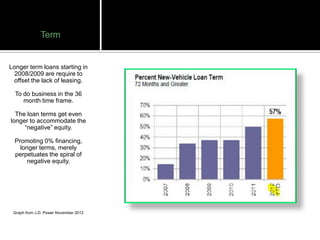

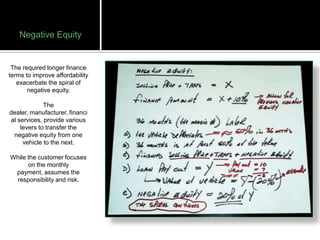

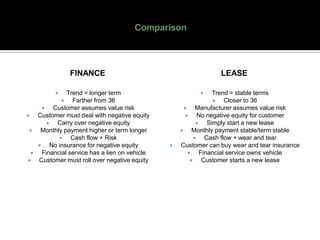

The automotive financial services industry in Canada has evolved significantly over time. Originally, companies like GM established financing divisions to enable customers to purchase vehicles through installment plans. Over the decades, financing and leasing became more complex, with manufacturers and dealers seeking to transfer vehicle value risk to customers. This led to issues like negative equity and longer loan terms for consumers. Manufacturers that maintained control over leasing programs were better positioned, while those relying solely on third-party financing ceded advantages. Technology has also played a major role in analyzing customers and structuring payments.