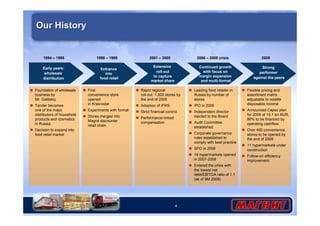

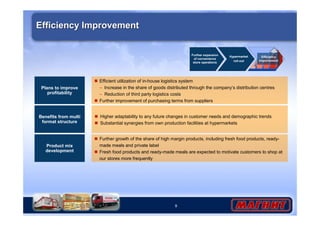

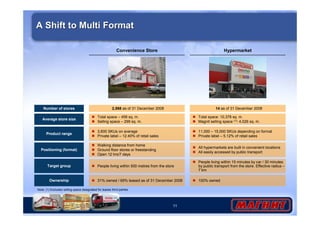

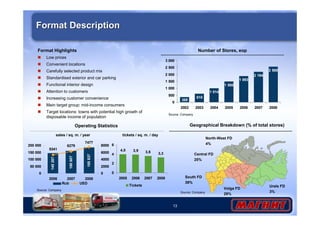

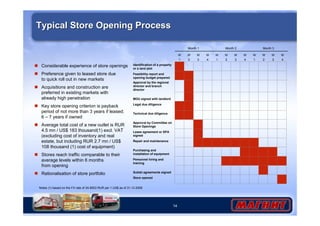

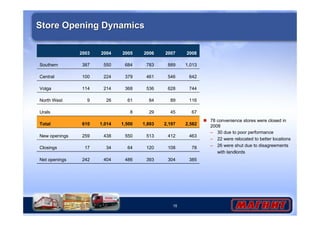

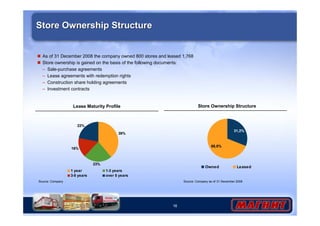

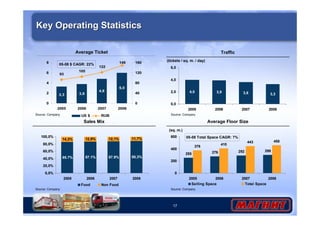

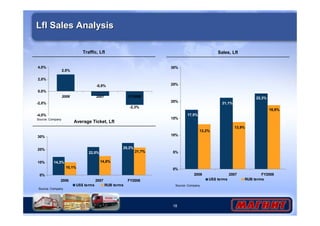

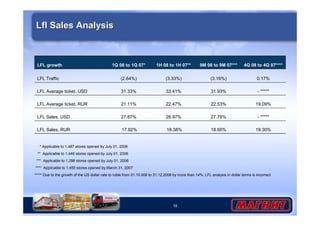

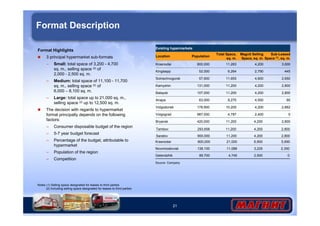

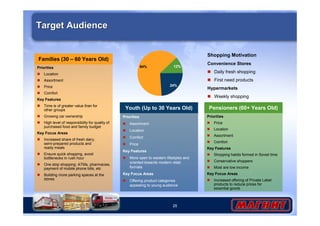

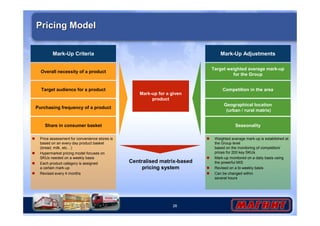

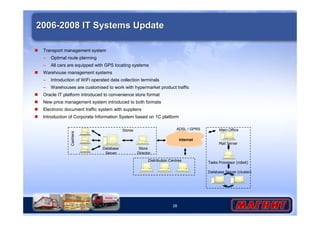

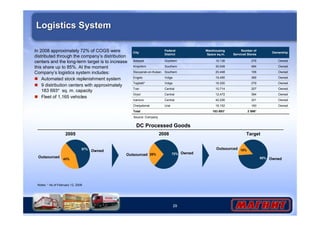

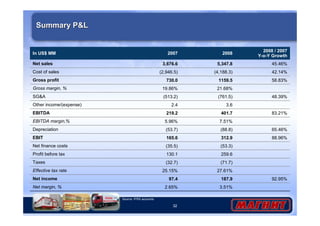

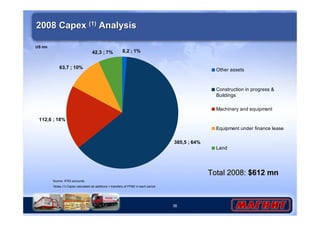

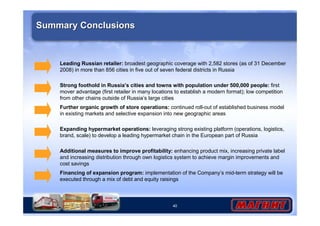

The document summarizes Magnit's 2008 results and provides an overview of its business. It discusses Magnit's continued expansion of its convenience store operations, with plans to add 250-400 stores annually. It also outlines Magnit's strategy to rollout hypermarkets in smaller Russian towns, with a target of 11 hypermarkets under construction by the end of 2009. The document highlights Magnit's focus on ongoing efficiency improvements across its expanding multi-format operations.