Magnit presented audited FY 2011 IFRS results. Key highlights include:

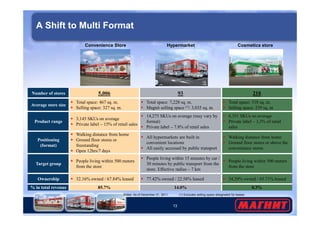

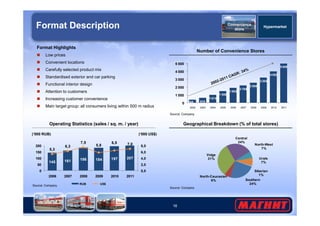

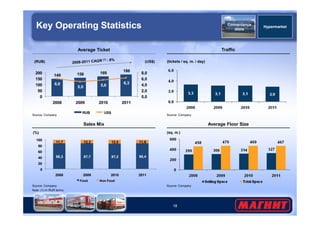

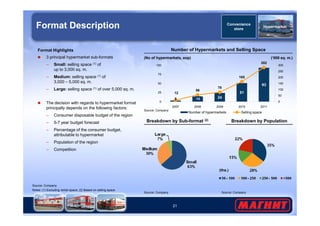

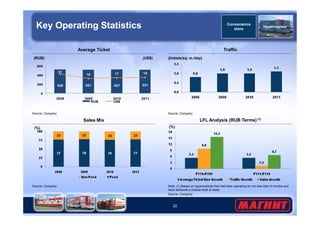

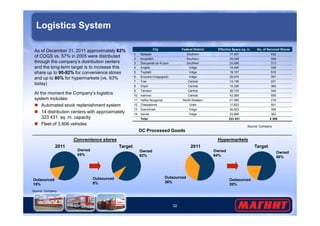

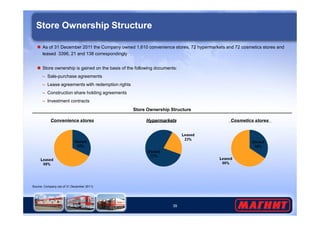

- Magnit operates 5,006 convenience stores, 93 hypermarkets, and 210 cosmetics stores across Russia as of 2011 year-end.

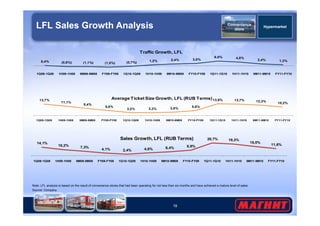

- Convenience stores represent the largest share of total revenue at 85.7%, with hypermarkets and cosmetics stores representing 14.0% and 0.3% respectively.

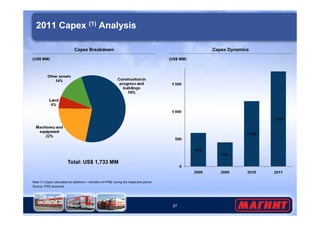

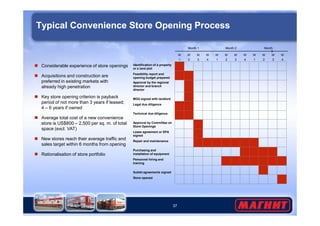

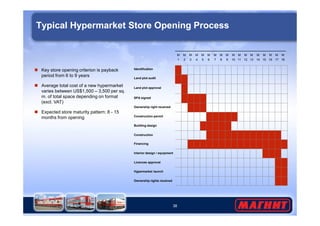

- Strategies going forward include further expanding the convenience store footprint, accelerating the hypermarket rollout, and improving operational efficiency.