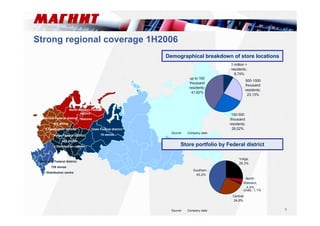

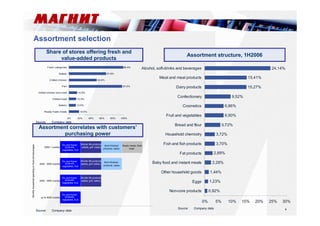

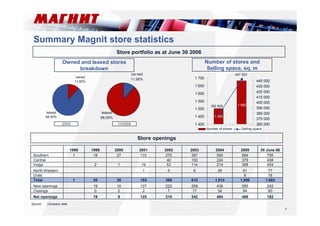

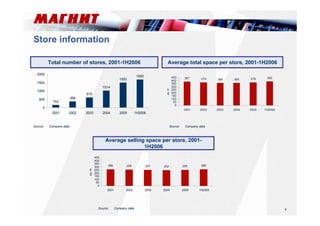

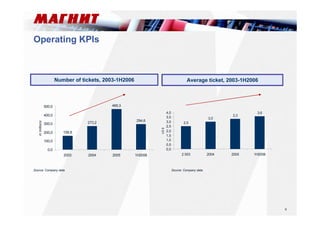

Magnit is the leading Russian food retailer with over 1,682 stores across European Russia as of June 30, 2006. In the first half of 2006, Magnit had net sales of $1,074.3 million and served over 294.6 million customers. Magnit focuses on providing a wide assortment of products including fresh and value-added items. Private label products account for over 10% of sales and Magnit aims to double this share by 2015. Magnit leverages its scale to obtain favorable purchasing terms from large national suppliers.