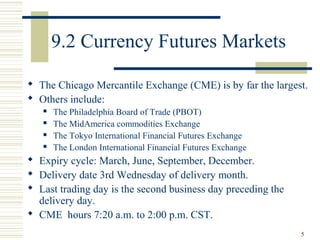

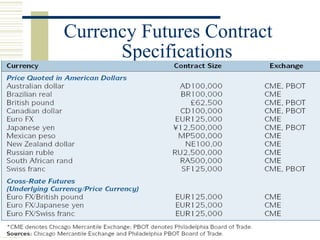

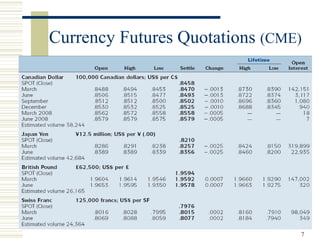

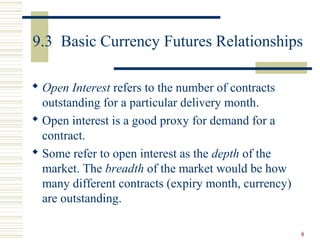

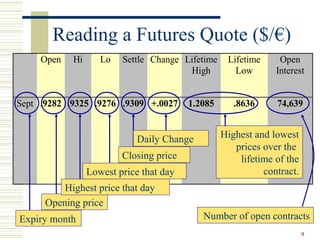

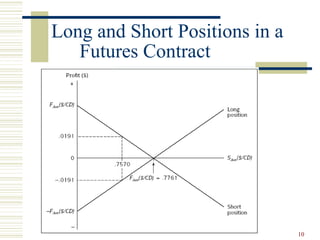

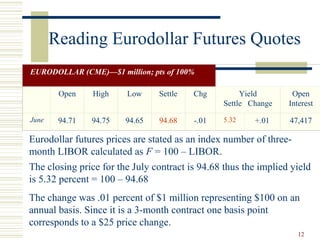

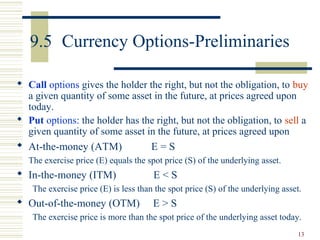

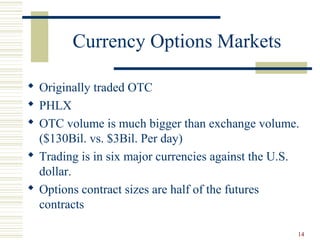

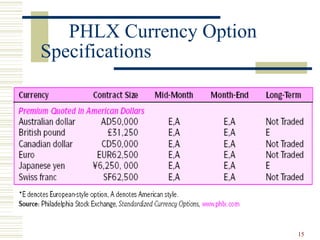

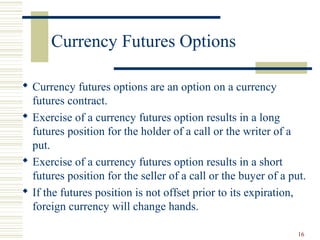

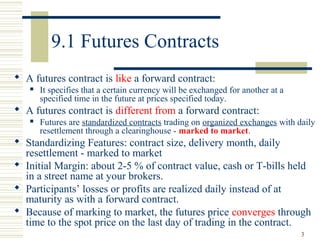

This document discusses futures and options contracts for foreign exchange. It begins by explaining the key differences between futures contracts and forward contracts, noting that futures are standardized contracts that are traded on organized exchanges and involve daily mark-to-market settlement. It then provides details on major currency futures markets, contract specifications, and how to read futures quotes. The document also introduces currency options, describing call and put options, and discusses currency futures options which provide exposure to futures contracts.

![4

Daily Resettlement = Marking to Market

Example: On Monday morning you take a long position in SF futures

contract that matures on Wednesday afternoon at $0.75/SF.

1. At the close of trading on Monday the futures price has risen to

$0.755. Because of the daily settlement you receive a cash profit of

$625 =125,000 x (0.755-0.75)

2. At Tuesday close the price has declined to $0.743. You must pay

the $1500 loss (125,000 x [0.743-0.755]) to the other side of the

contract.

3. At Wednesday close, the price drops to $0.74, and the contract

matures. You pay $375 loss to the other side and take the delivery

of the SF, paying the prevailing price of $0.74. You have a net loss

on the contract of $1250 (625-1500-375)

You can also close out your long position with an offsetting trade, if

you don’t want the delivery of the SF.](https://image.slidesharecdn.com/futuresvsforextradingbytradee12-161129093322/85/Futures-vs-forex-trading-by-Trade12-4-320.jpg)