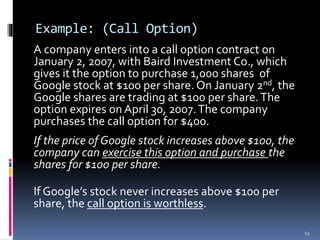

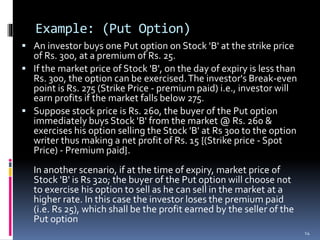

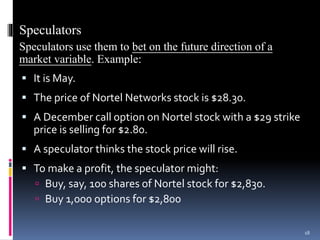

This document provides an overview of futures and options. It defines derivatives as contracts between buyers and sellers, and notes the most common types are forwards, futures, options, and swaps. Futures contracts involve an agreement to exchange an asset at a later date for a price set now, while options provide the right but not obligation to buy or sell an underlying asset. The document discusses the advantages and disadvantages of trading derivatives over-the-counter versus on exchanges. It provides examples of how futures, calls, and puts work and concludes that derivatives have increasingly attracted investors for both hedging risks and speculative purposes.