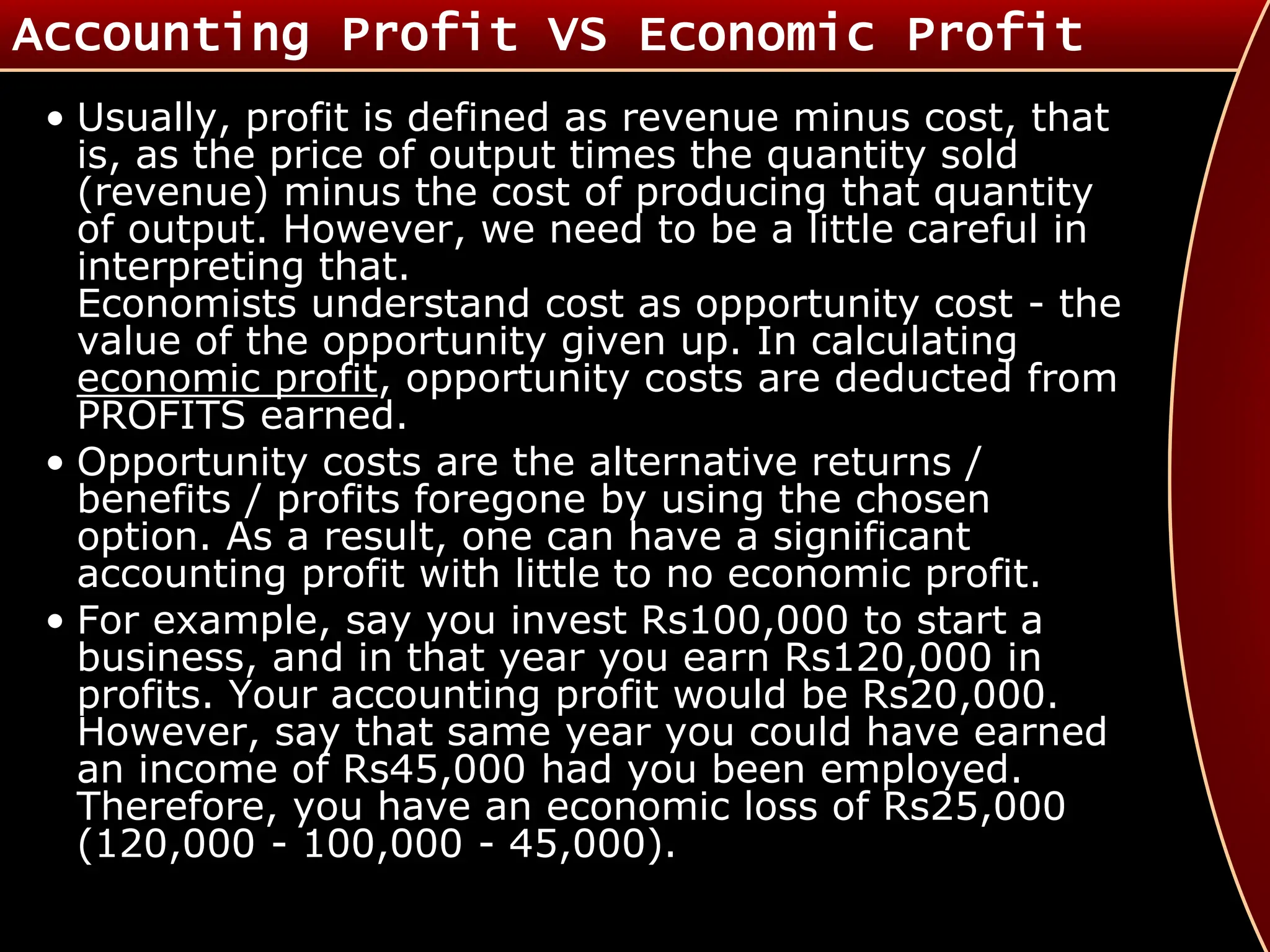

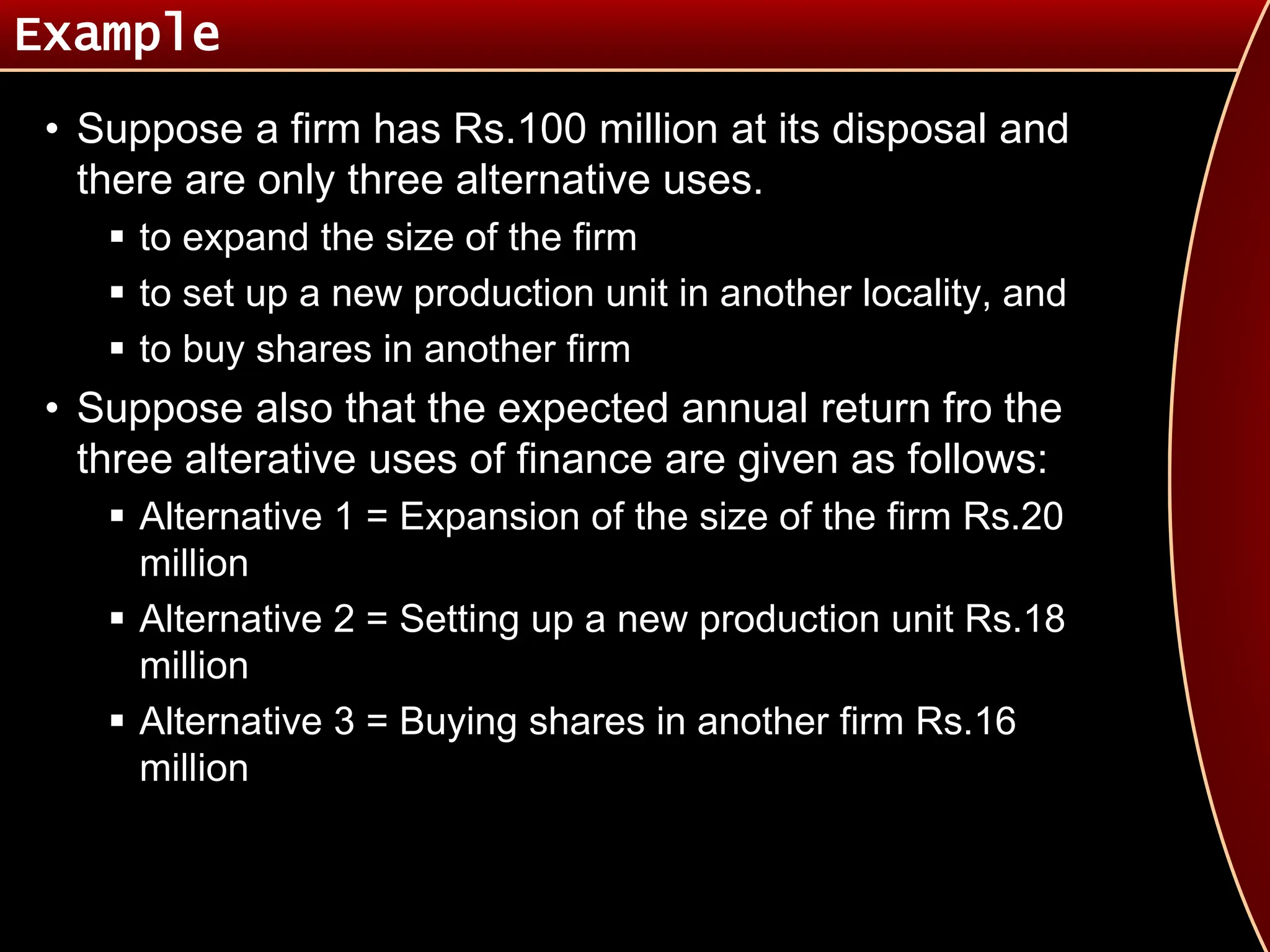

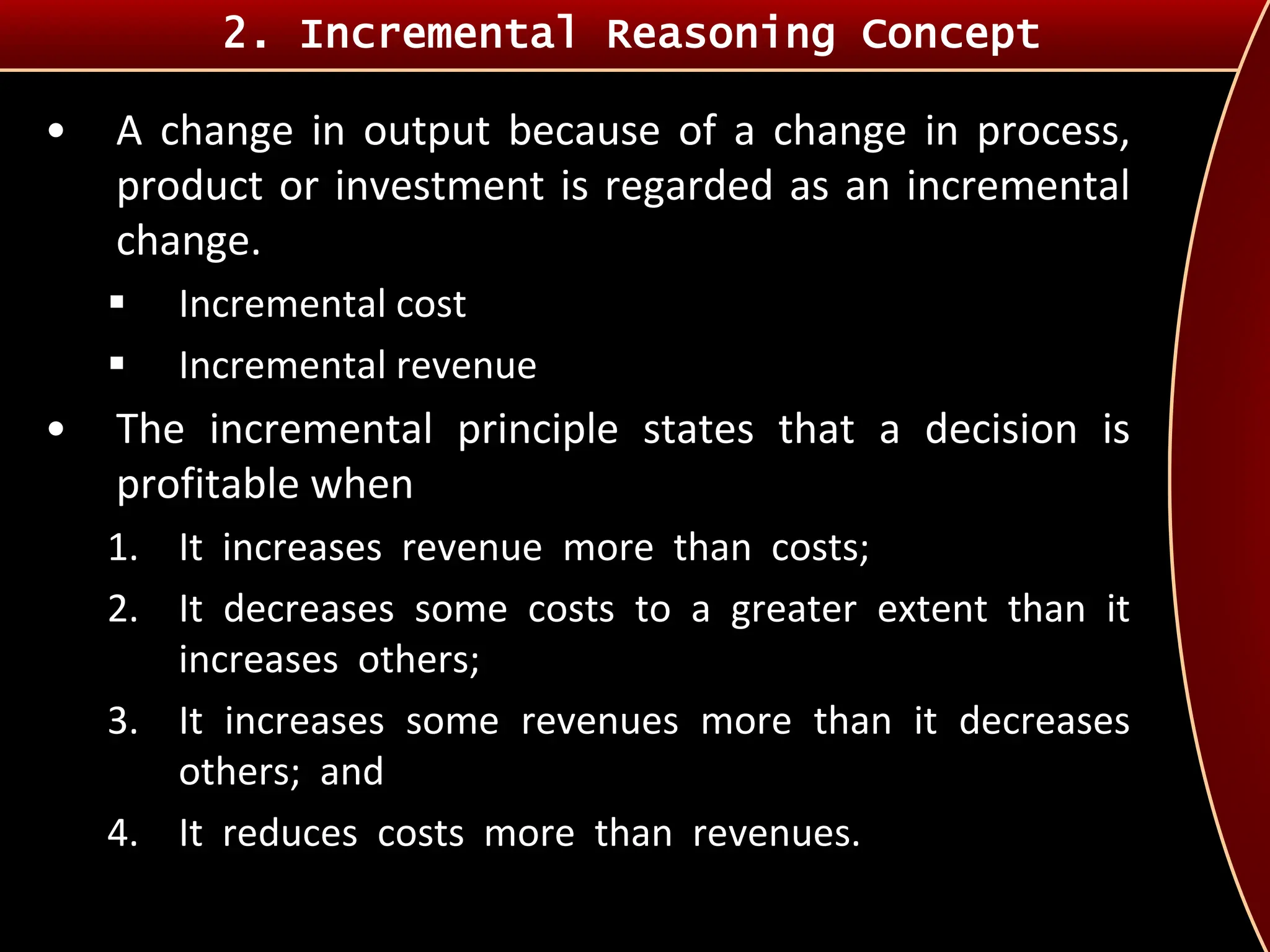

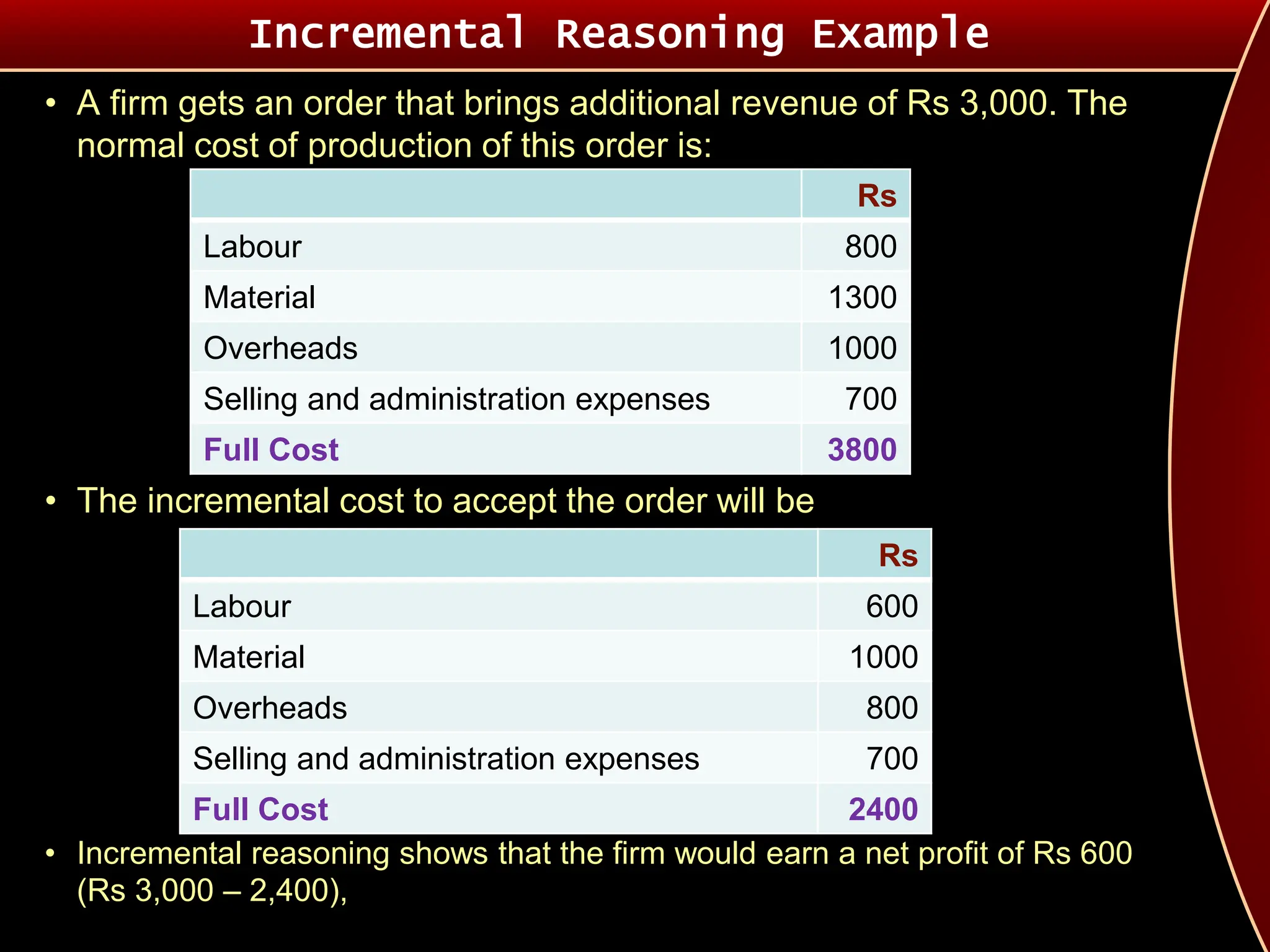

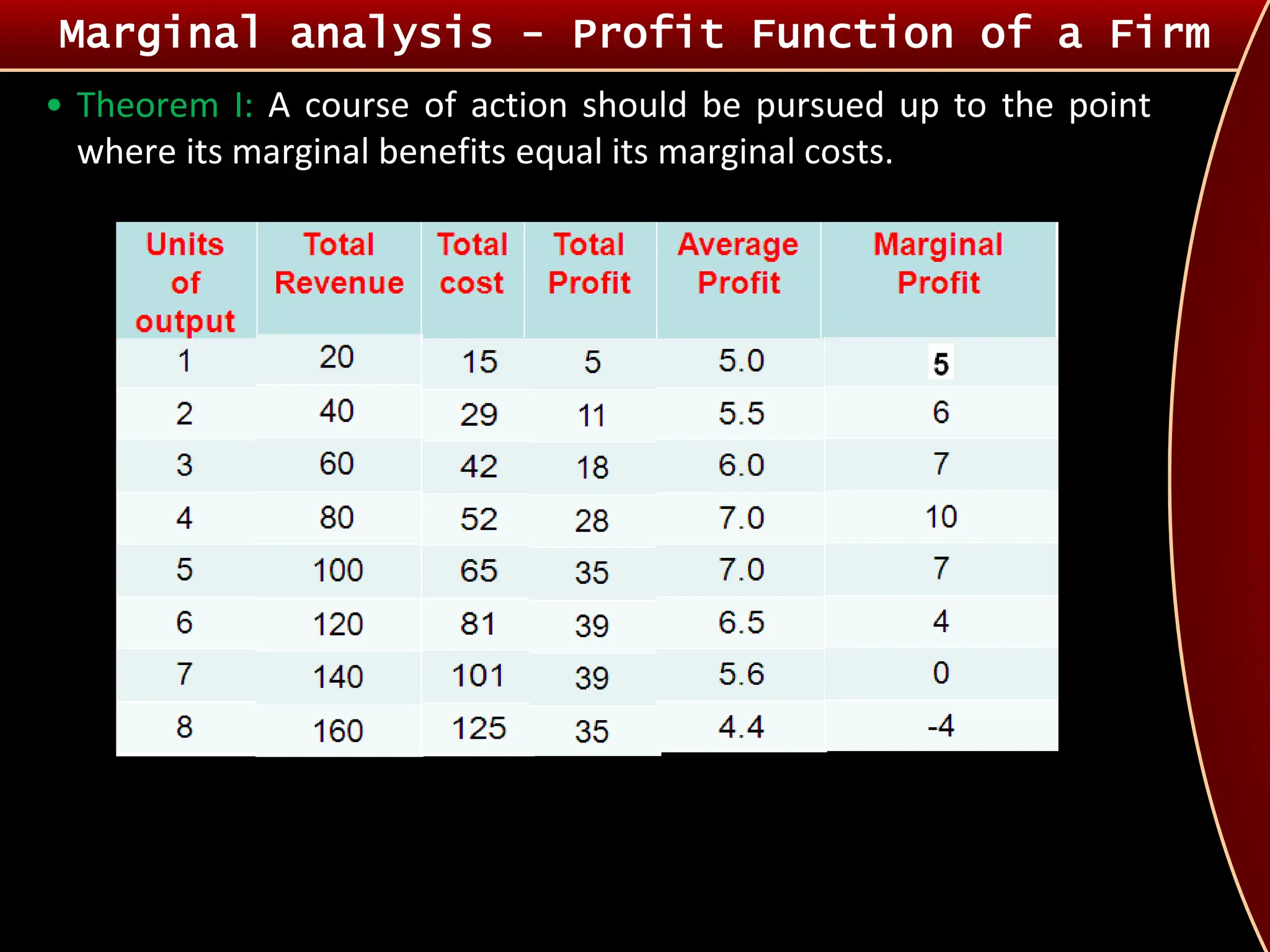

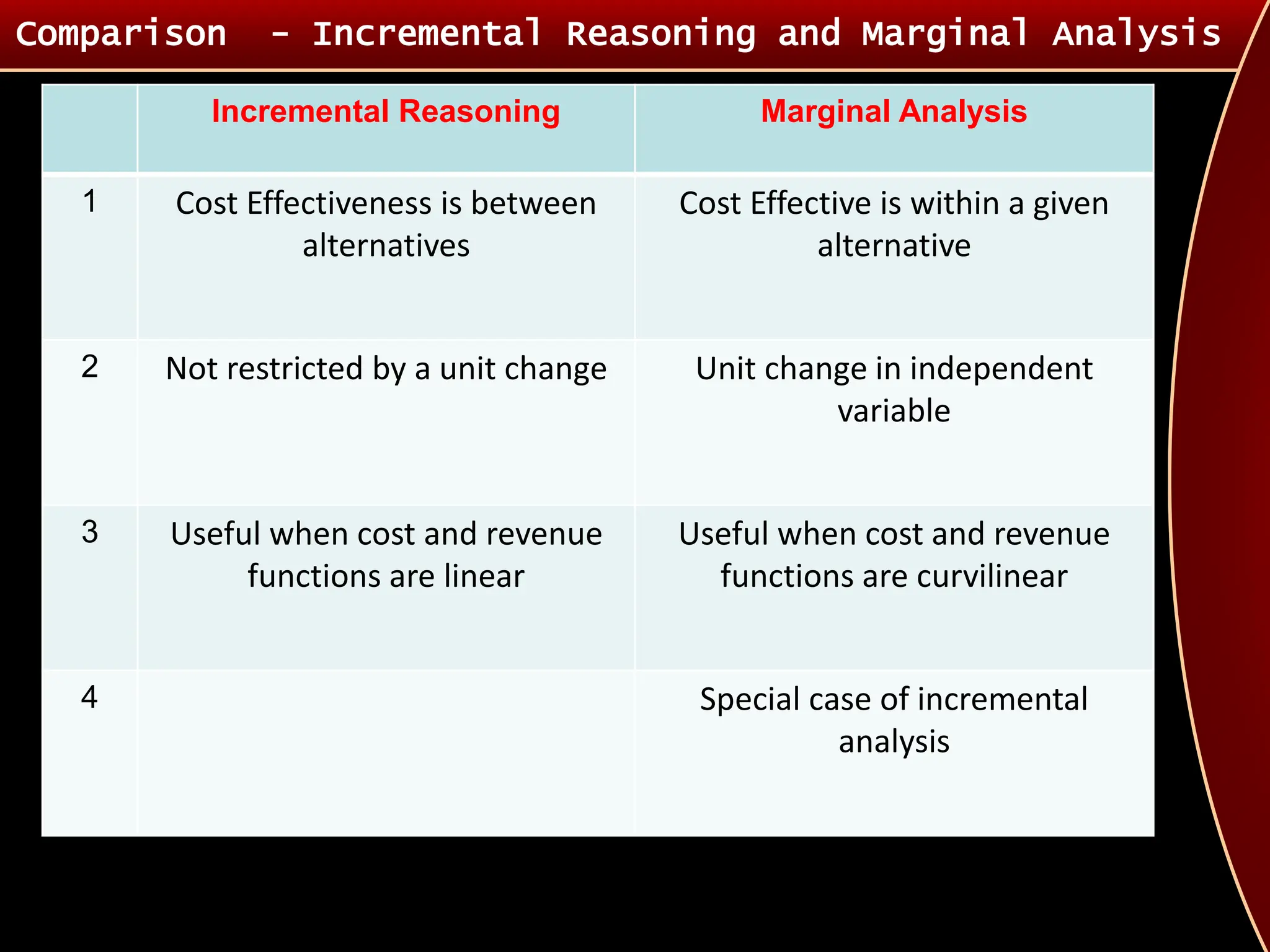

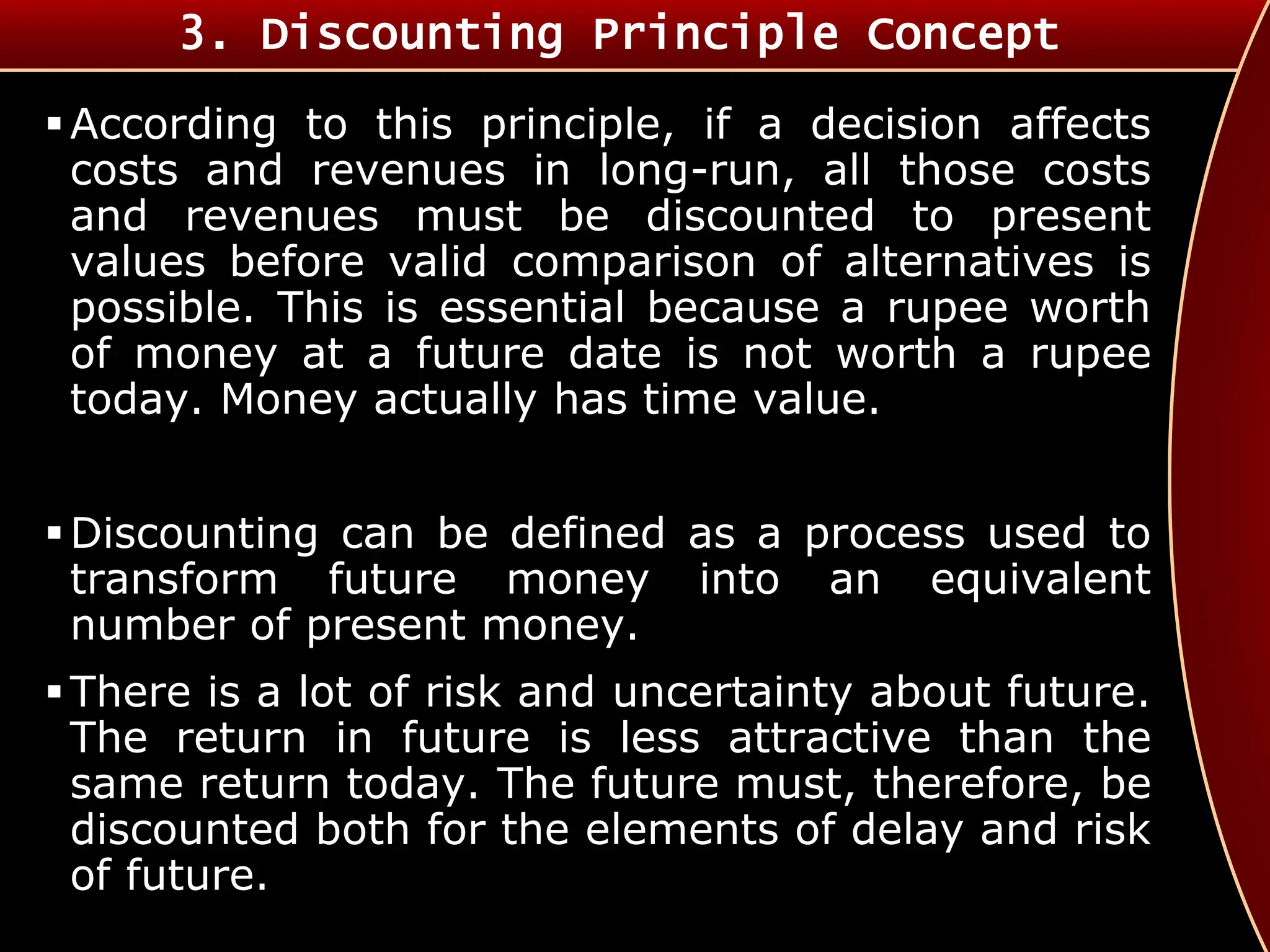

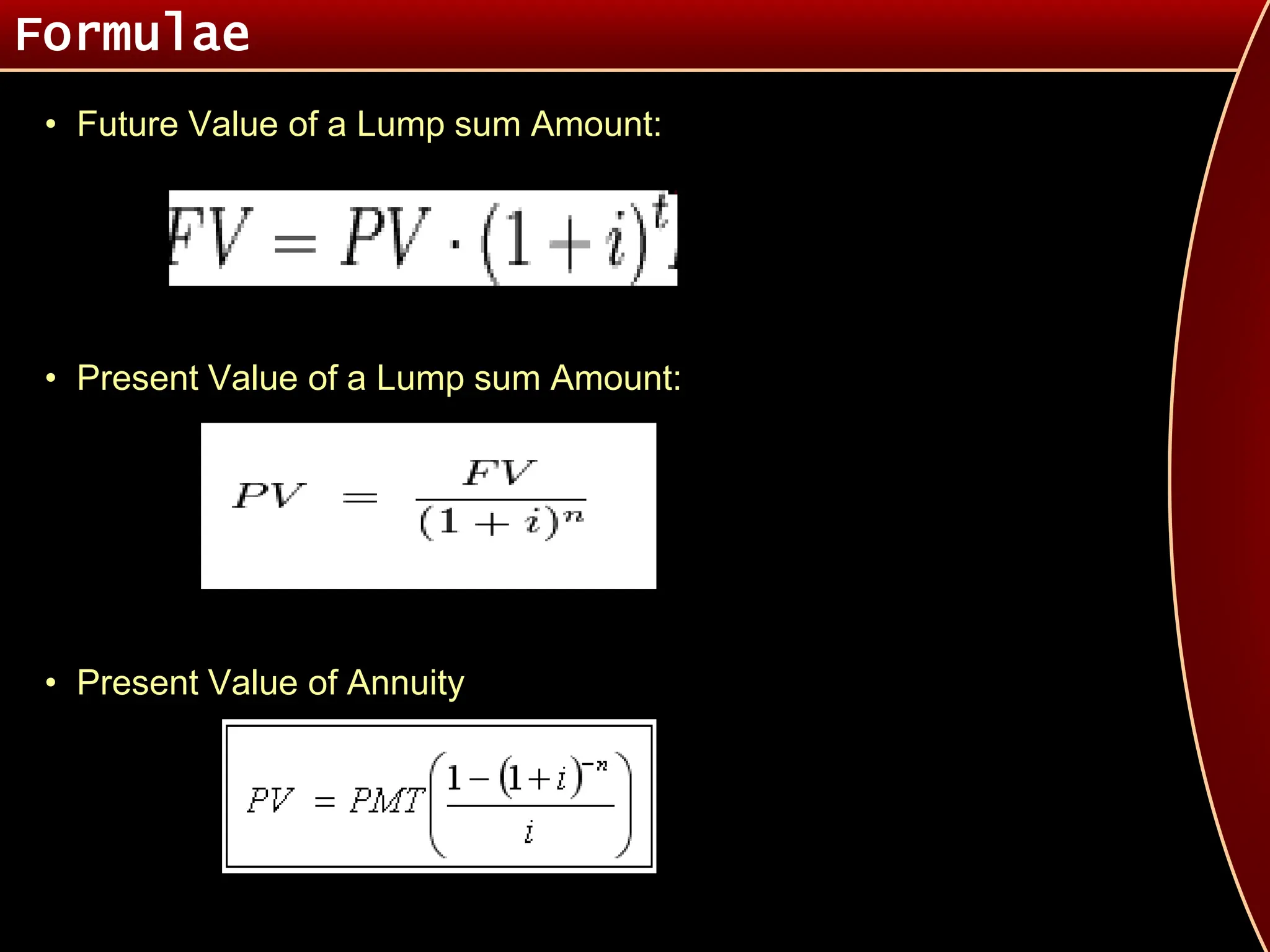

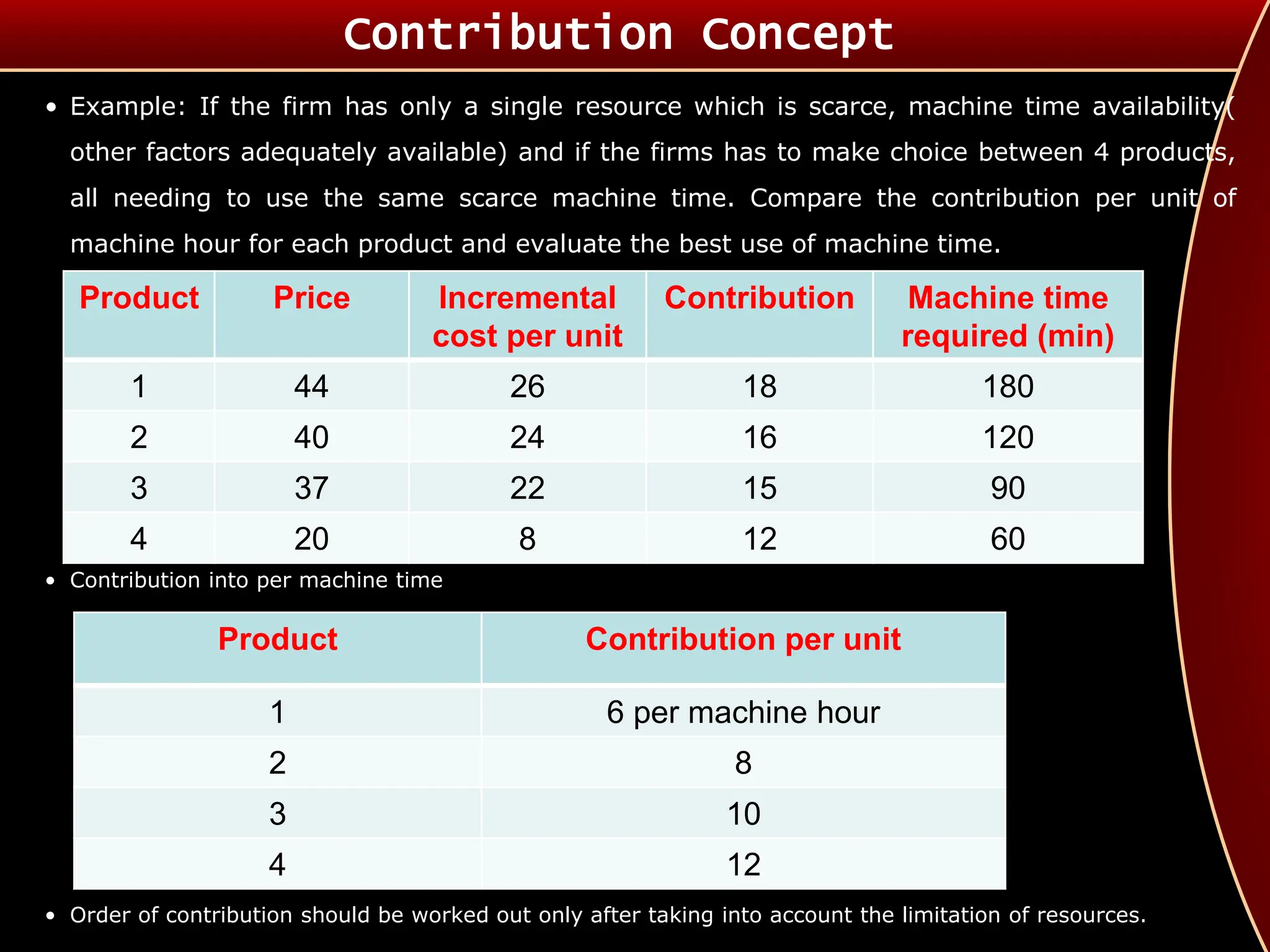

Chapter 2 of the document outlines fundamental concepts of managerial economics, emphasizing allocation decisions driven by scarcity, opportunity costs, and incremental reasoning. Key principles include the distinction between accounting and economic profit, discounting future values to present values, and the importance of time perspective in decision-making. Additionally, it covers the equi-marginal principle, which asserts that resources should be allocated to equalize the ratio of marginal returns to marginal costs across various uses.