This document provides an introduction to the concepts of managerial economics. It discusses:

1) The scope of managerial economics, including resource allocation, pricing problems, investment decisions, and linking economic theory to business decisions.

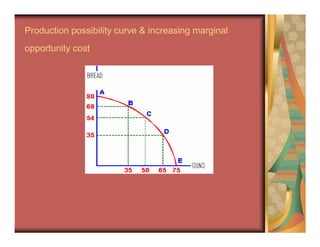

2) Fundamental principles like opportunity cost, production possibility curves, marginal analysis, and the incremental principle for evaluating investment decisions.

3) Key concepts in decision making like time perspective, efficient allocation of resources using the equimarginal principle, and discounting future cash flows using present value calculations.