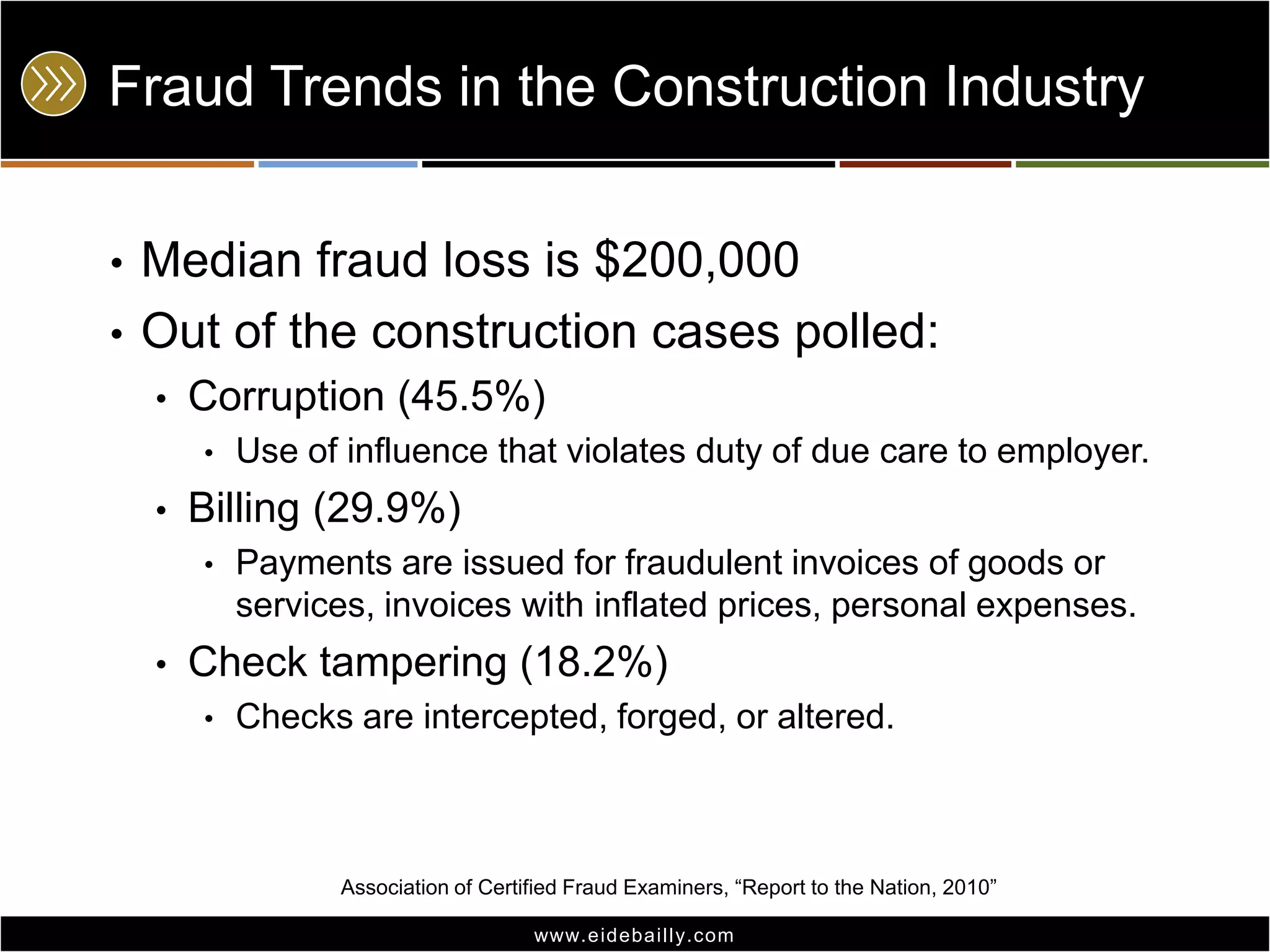

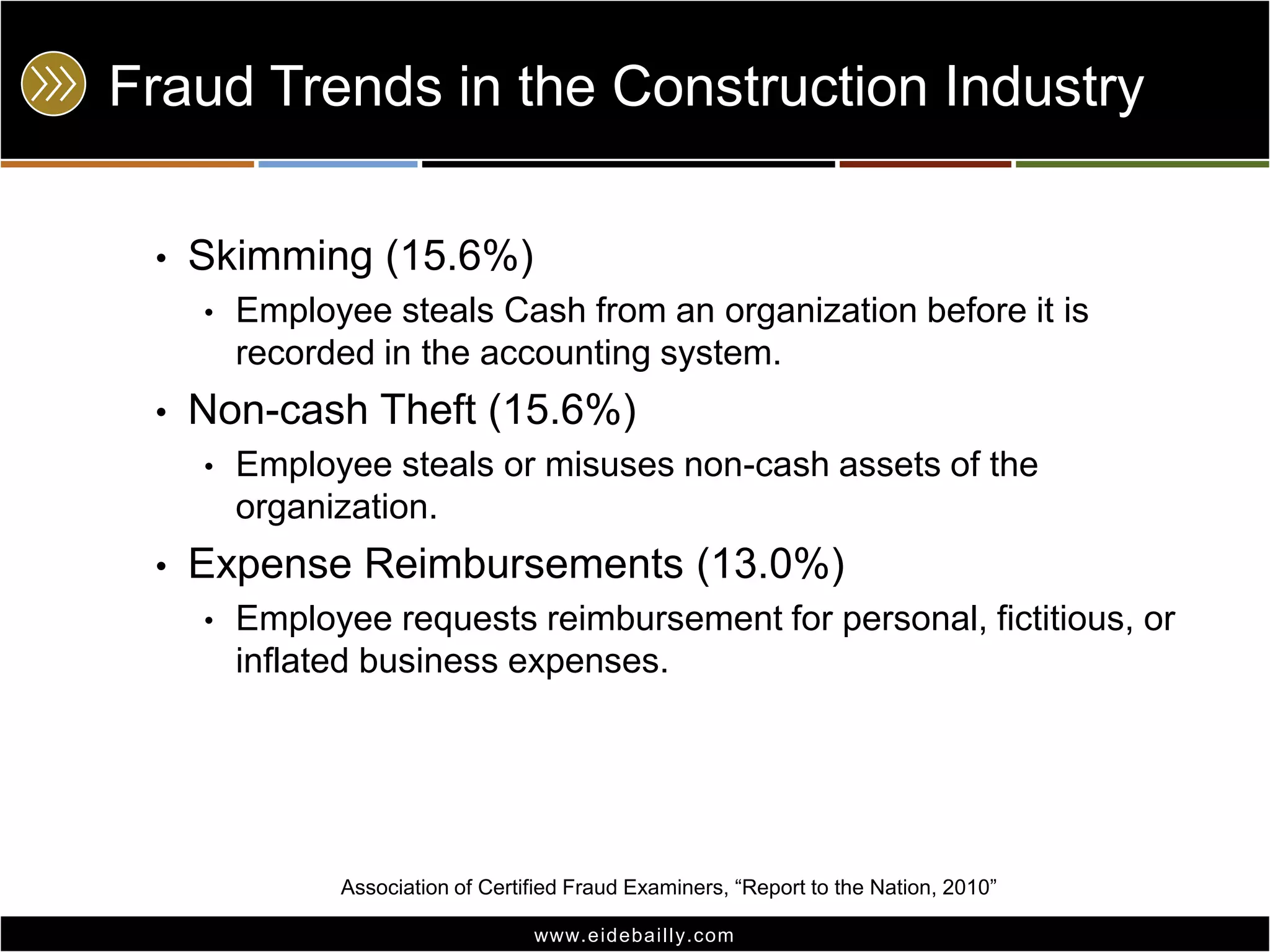

The document discusses trends in fraud, including that fraud occurrences have increased since the 2008 economic crisis. Theft of company property and embezzlement have seen the greatest increases. Most frauds are uncovered by tips, management review, or internal audit. For construction companies specifically, the most common fraud schemes are corruption, billing, check tampering, skimming, and expense reimbursements, with the median fraud loss being $200,000. The document also outlines the fraud triangle of opportunity, pressure, and rationalization as factors that can contribute to fraud. It provides recommendations for fraud prevention, including eliminating opportunity through strong internal controls and increasing the perception of detection.