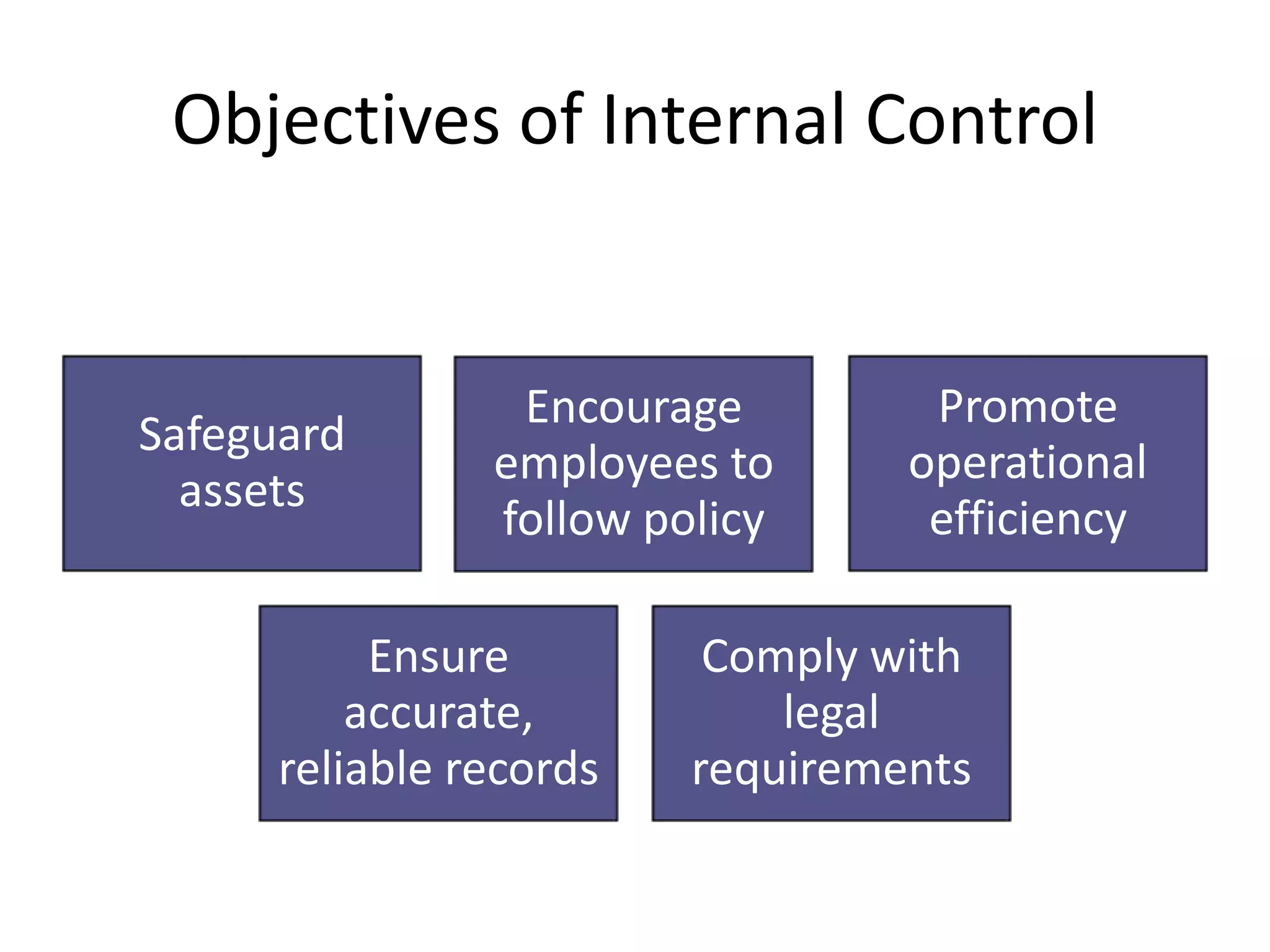

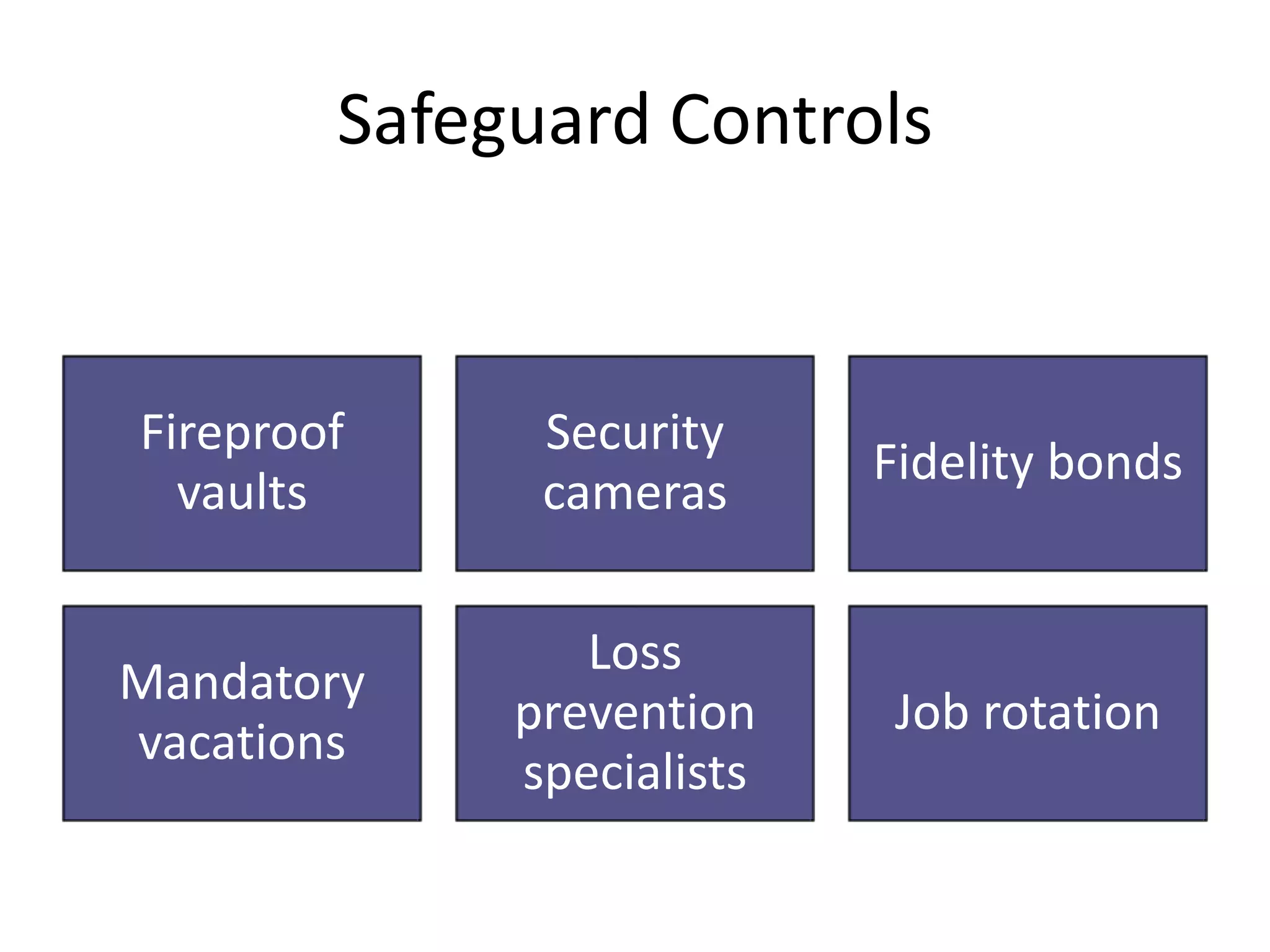

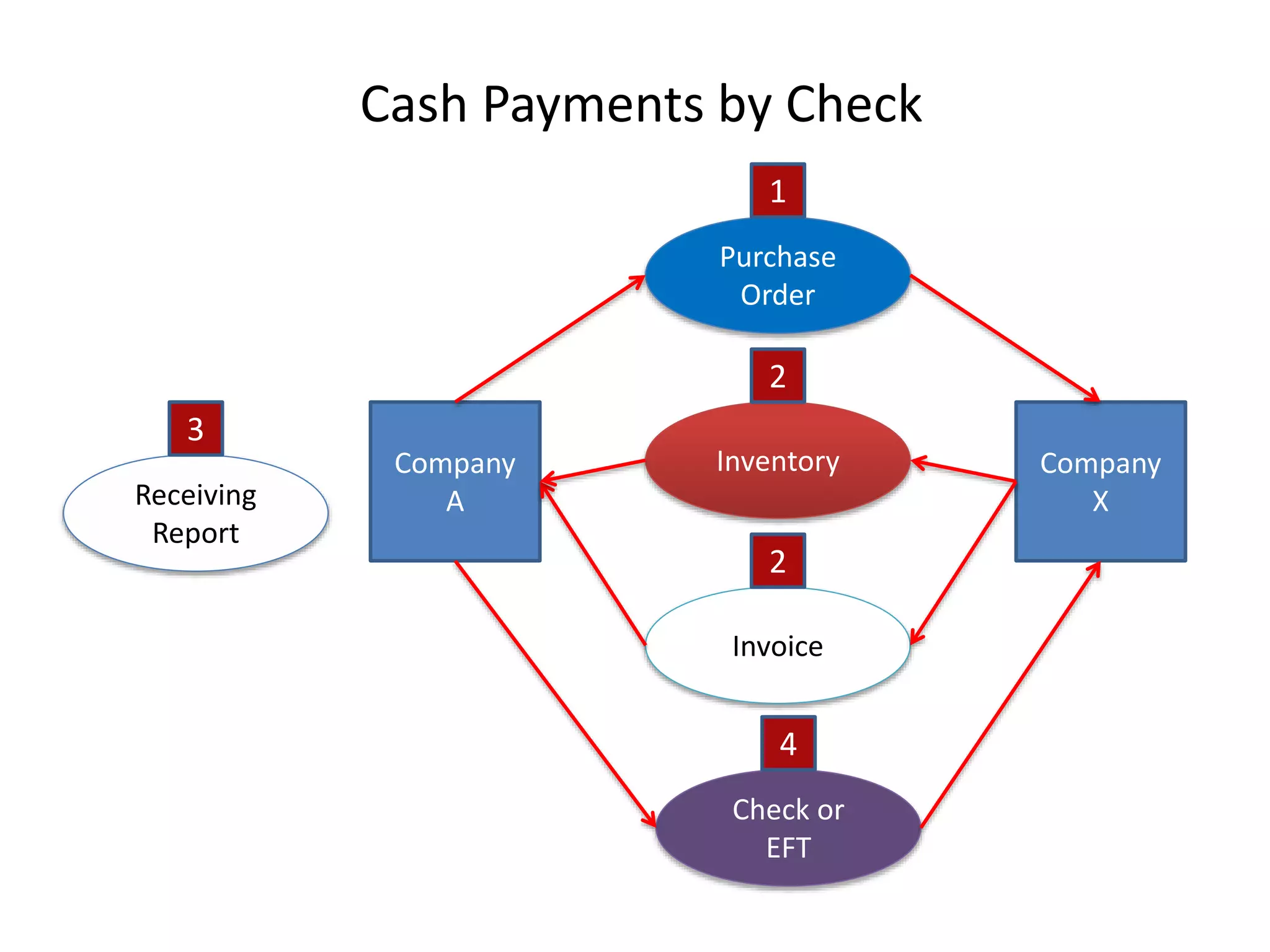

This document summarizes key concepts around fraud, internal controls, and cash handling procedures. It defines fraud and describes common types like misappropriation of assets and fraudulent financial reporting. It then outlines the fraud triangle and discusses internal controls, including their objectives to safeguard assets and ensure accurate records. Specific internal control components and procedures are defined, like segregation of duties, approvals, and limited access. Procedures for handling cash receipts, payments, and purchasing are summarized.