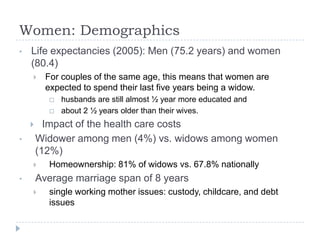

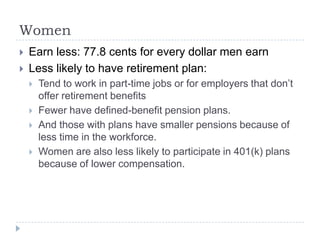

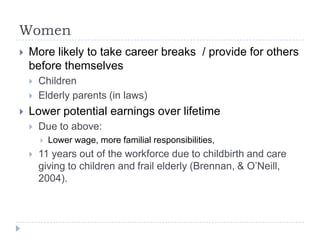

The document discusses the unique financial planning needs of women, highlighting their longer life expectancies and resulting retirement challenges, including lower earnings and less access to retirement benefits. It emphasizes the importance of proactive retirement planning, understanding social security benefits, and seeking professional financial advice. Additionally, it presents strategies for effective personal finance management tailored to women's circumstances in the current economic landscape.