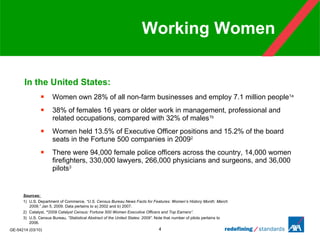

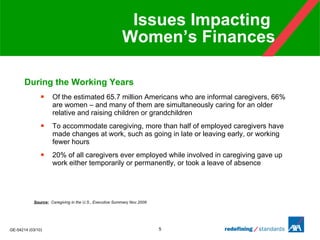

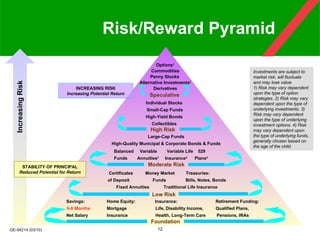

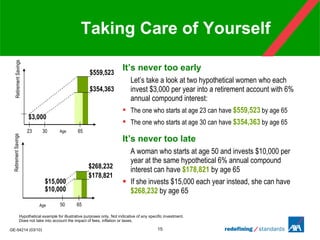

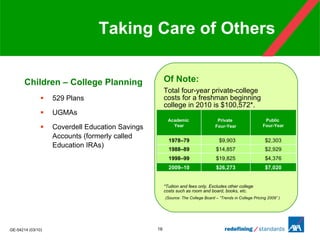

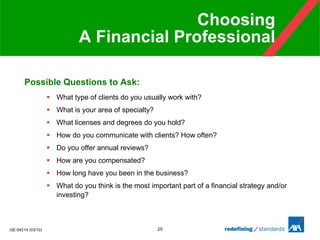

The document outlines a financial wellness seminar aimed at educating women about financial strategies throughout their lives, emphasizing the importance of planning for various stages of life. It discusses statistics on women's participation in the workforce and the unique financial challenges they face, including caregiving responsibilities and retirement planning. Additionally, it provides guidance on setting financial goals, investment strategies, and the importance of consulting with financial professionals.