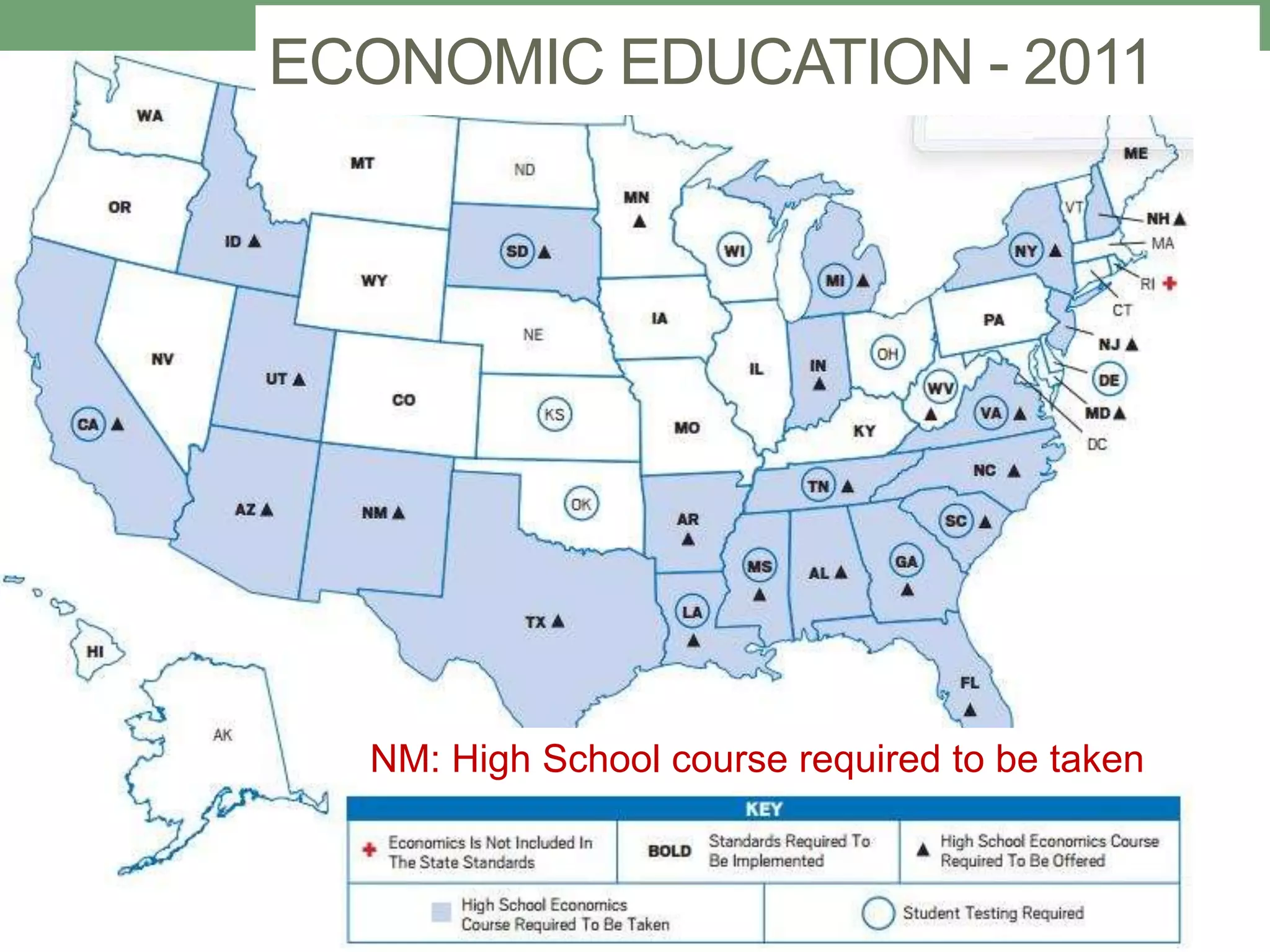

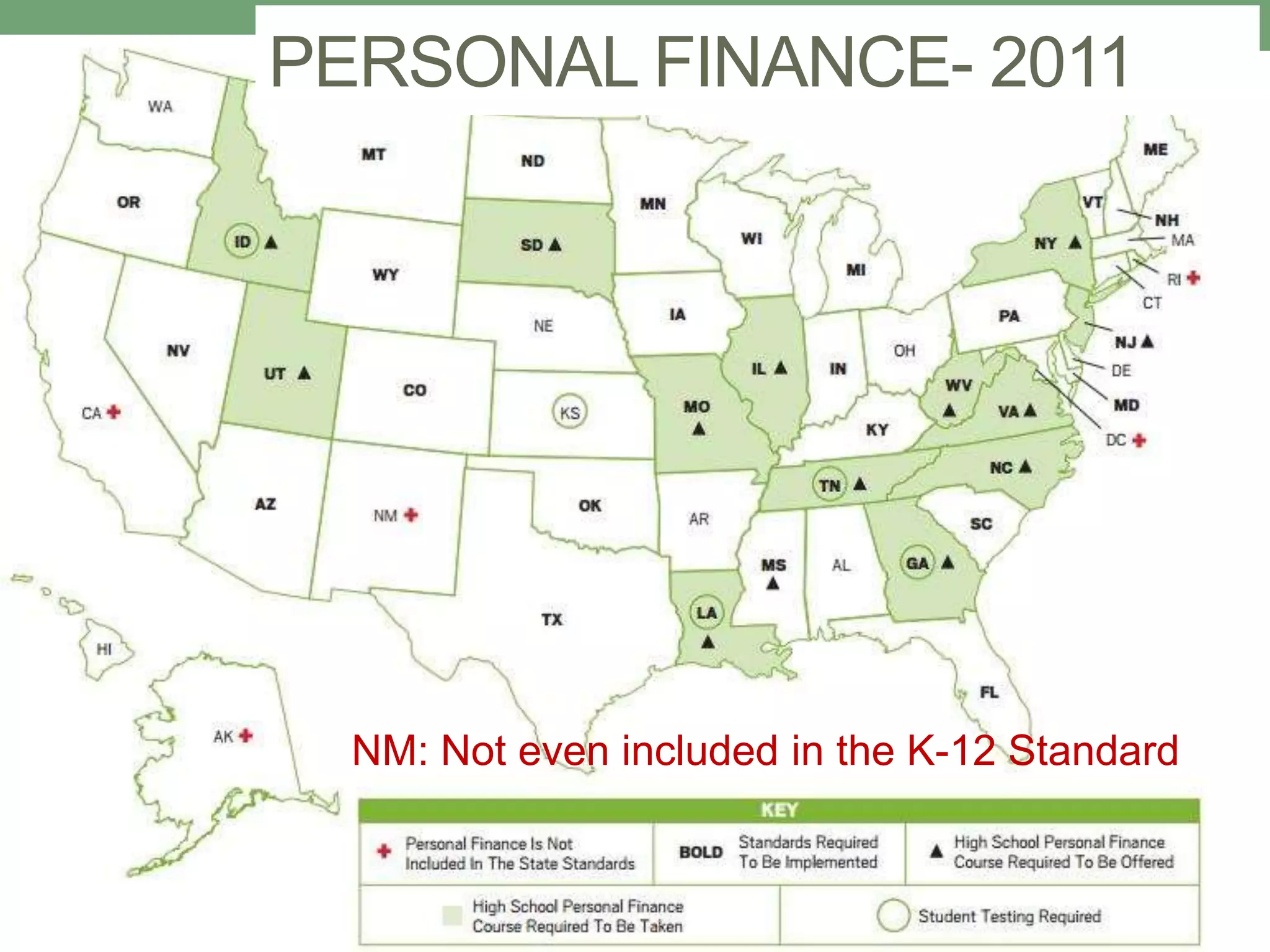

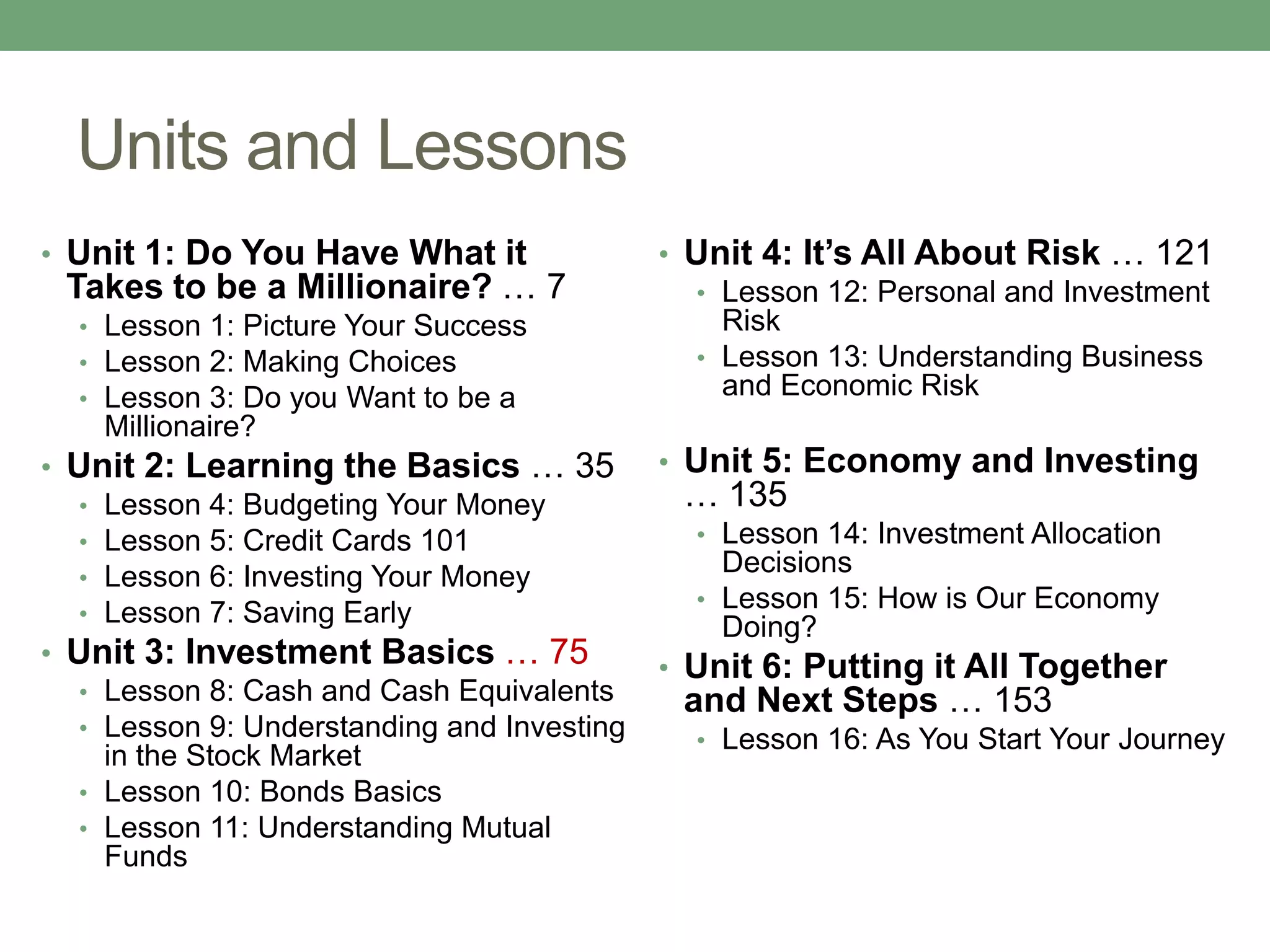

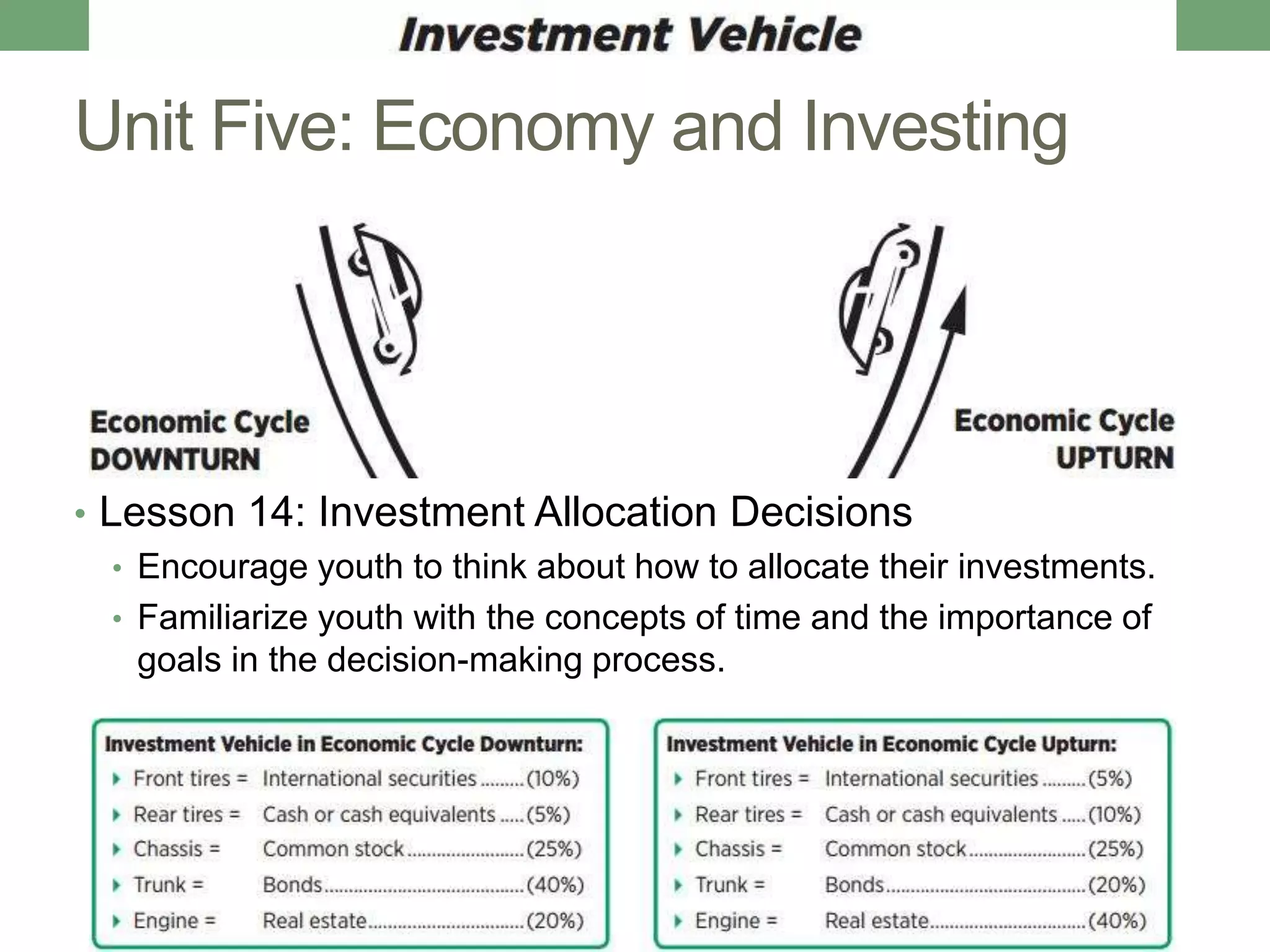

The document outlines the '4-H Build a Million' curriculum aimed at teaching financial literacy to high school students, highlighting the lack of formal finance education among teachers. It discusses the current economic challenges, including high unemployment and significant college debt, and introduces an educator guide composed of six units with interactive lessons on budgeting, investing, and risk management. The program, funded by the FINRA Investor Education Foundation, is designed to be adaptable for various educational settings and is offered free of charge.