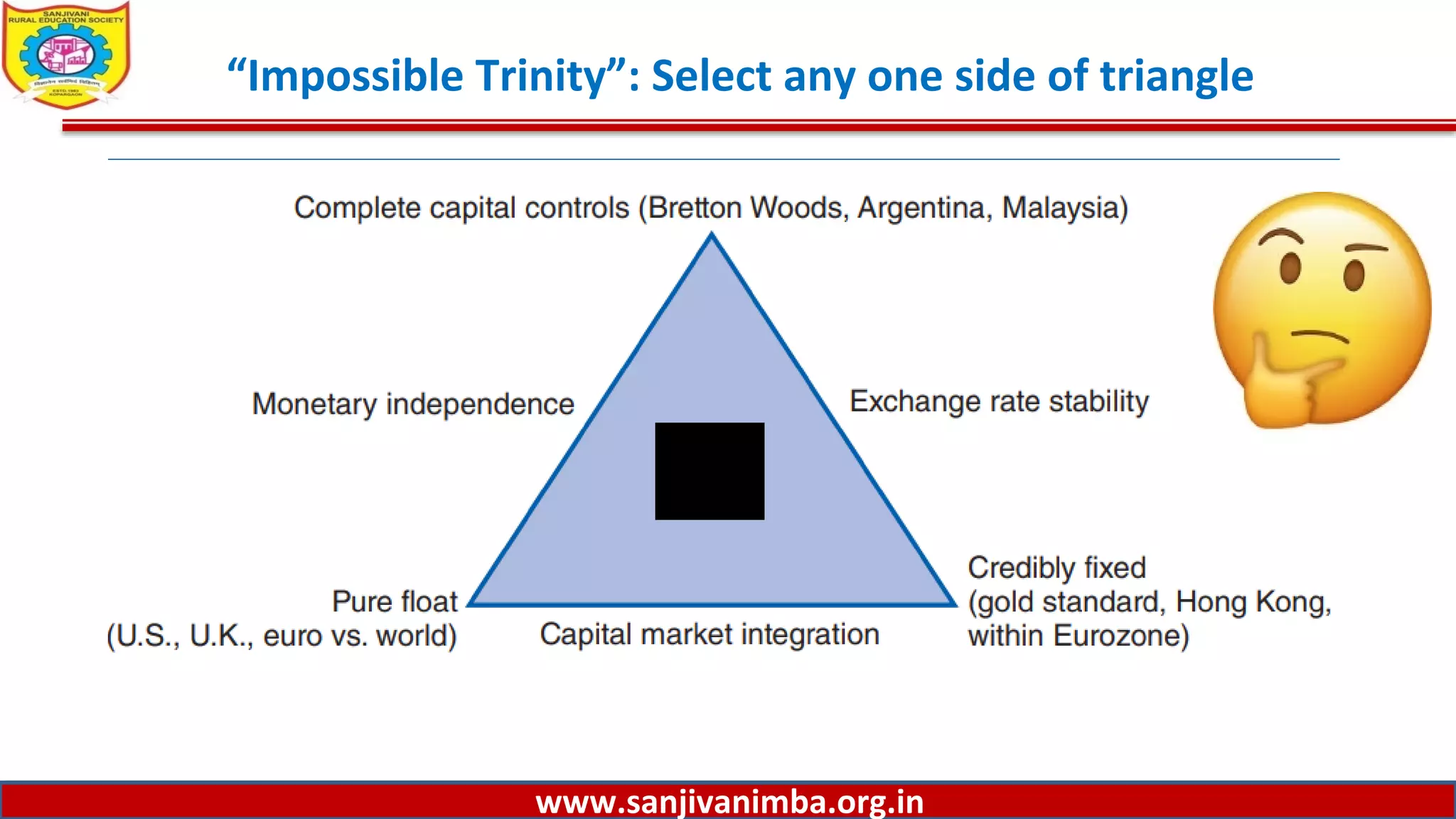

The document discusses different exchange rate systems throughout history and currently used around the world. It describes the "impossible trinity" where a country can only choose two out of three options: a stable exchange rate, independent monetary policy, and free capital movement. Under the flexible exchange rate system adopted in 1973 after Bretton Woods, rates are determined by markets with possible government intervention. There are currently around 10 exchange rate arrangements recognized by the IMF ranging from currency boards to free floats.