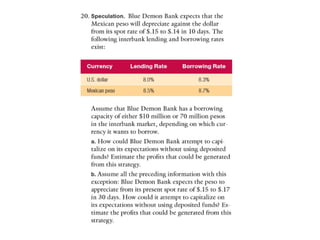

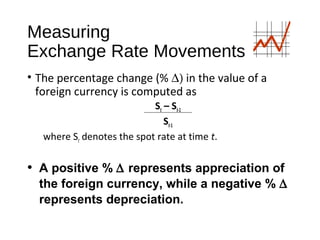

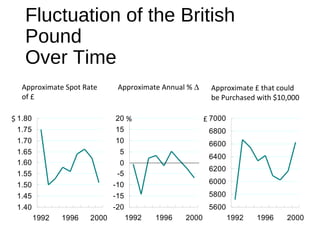

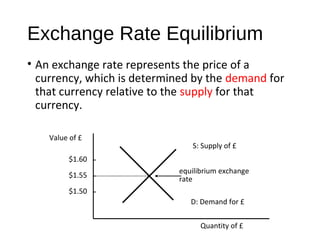

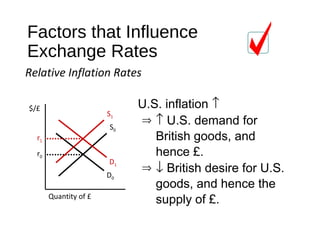

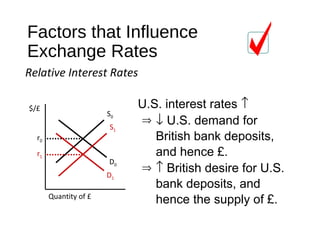

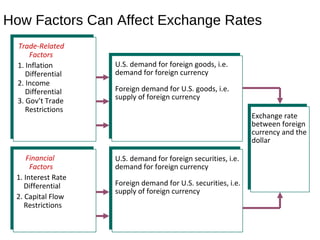

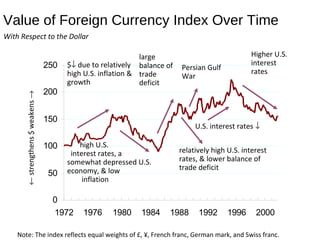

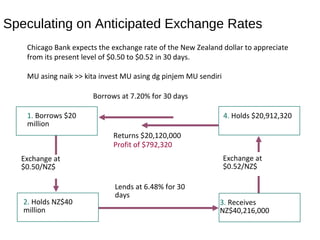

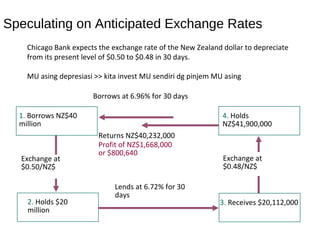

The document discusses exchange rate determination, detailing how movements are measured, equilibrium exchange rate forces, and influencing factors like inflation, interest rates, and government controls. It describes currency appreciation and depreciation, along with how demand and supply impact exchange rates, noting the significance of expectations and speculative transactions. Furthermore, it examines the interaction of various economic factors and their effects on currency valuation and multinational corporations' value.

![Impact of Exchange Rates on an MNC’s Value

( ) ( )[ ]

( )∑

∑

+

×

=

n

t

t

m

j

tjtj

k1=

1

,,

1

ERECFE

=Value

E (CFj,t ) = expected cash flows in currency j to be

received by the U.S. parent at the end of period t

E (ERj,t ) = expected exchange rate at which

currency j can be converted to dollars at the end of

period t

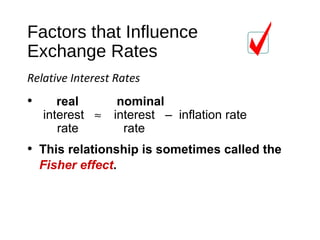

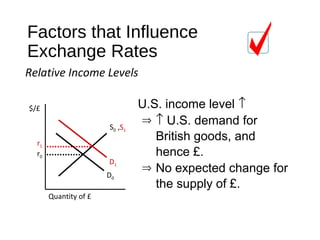

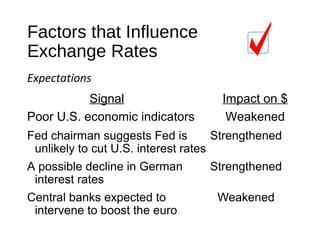

Inflation Rates, Interest Rates,

Income Levels, Government Controls,

Expectations](https://image.slidesharecdn.com/mki04-180312041546/85/Exchange-Rate-Determination-22-320.jpg)