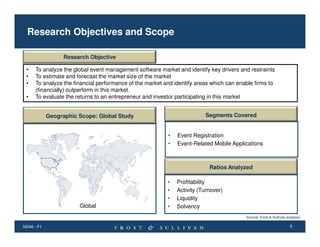

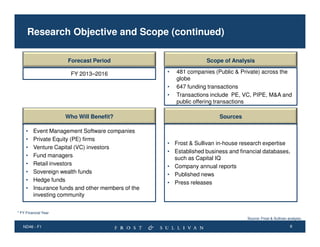

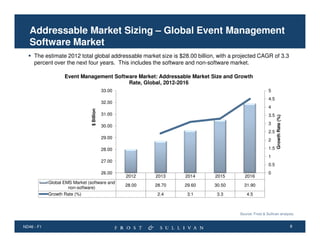

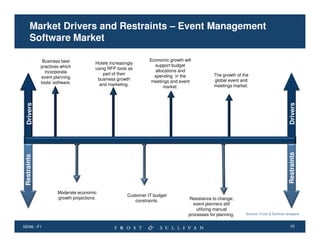

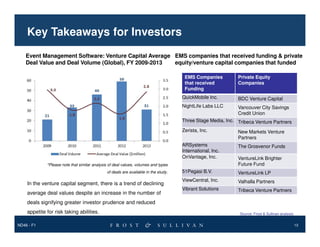

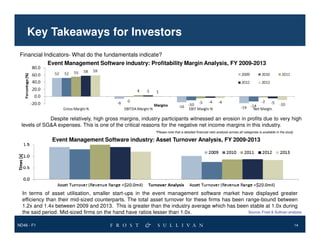

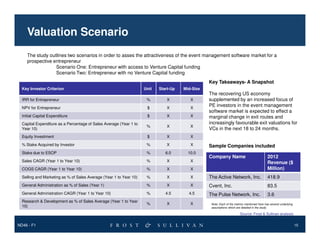

The document provides an analysis of the global event management software market from 2013 to 2016. It finds that the market was worth $28 billion in 2012 and is projected to grow at a 3.3% CAGR to $32 billion by 2016. The market is highly fragmented with over 300 companies and no player having more than 20% market share in the US. While companies have high gross margins, many suffer losses due to high spending on sales and marketing. The analysis finds that startups have better asset usage than mid-sized firms. It also provides valuation scenarios for entrepreneurs, finding higher potential returns for those able to obtain venture funding.