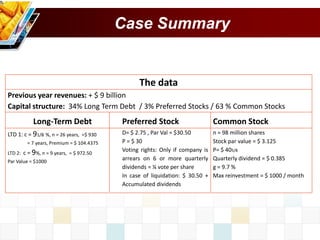

1. The document provides financial information about a company including its capital structure, long-term debt instruments, preferred stock, and common stock.

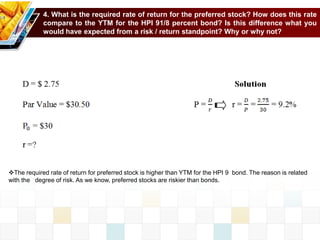

2. Key figures given include annual revenues of $9 billion, a capital structure of 34% long-term debt, 3% preferred stock, and 63% common stock. Details are provided on two long-term debt instruments, the preferred stock, and the common stock.

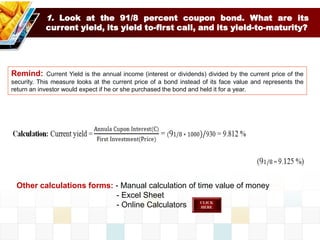

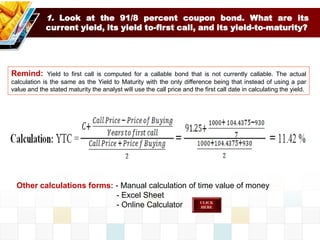

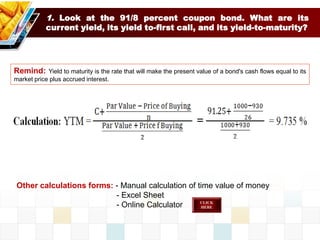

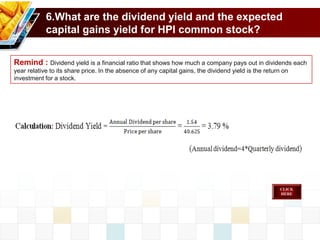

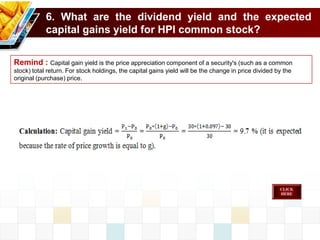

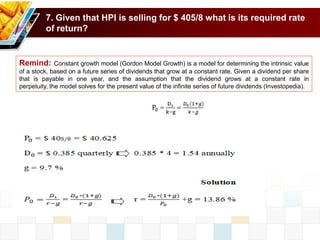

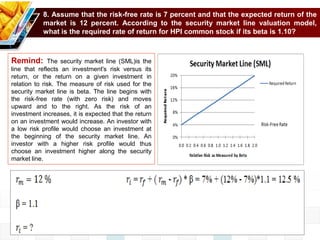

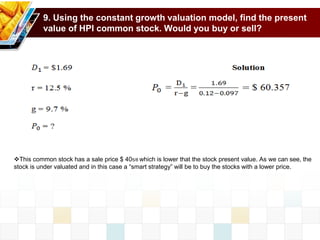

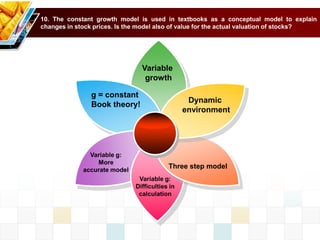

3. The document poses 10 questions asking the reader to calculate various metrics like yield and required rate of return based on the information provided, and to evaluate whether investments in the company's bonds and stock would be recommended.