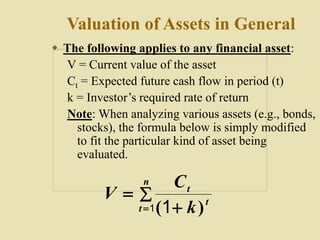

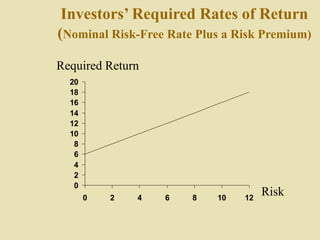

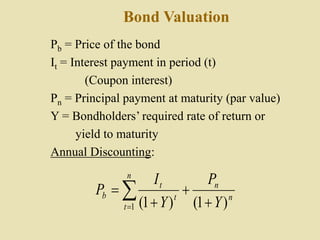

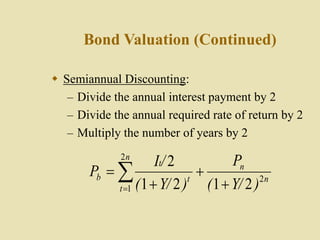

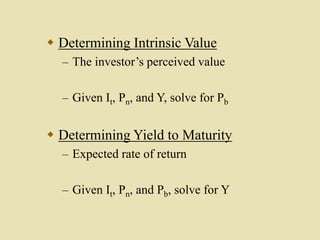

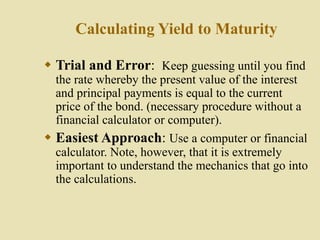

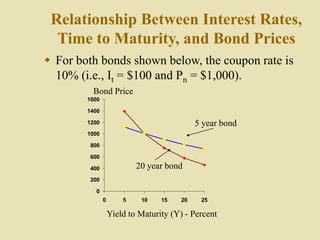

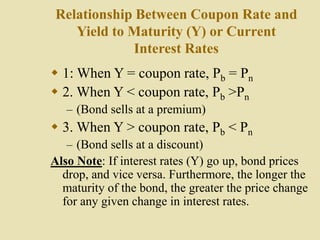

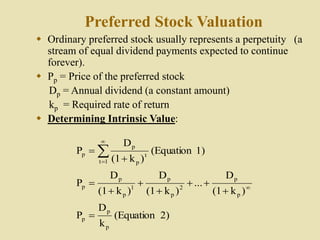

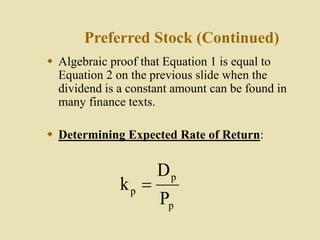

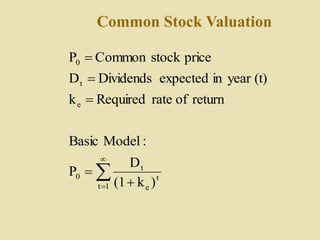

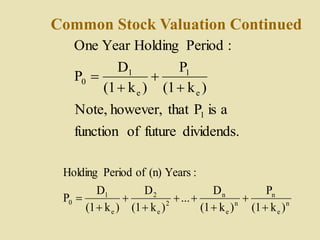

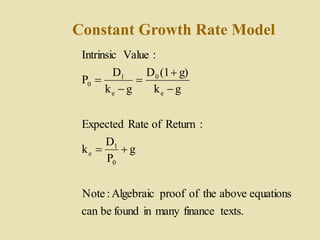

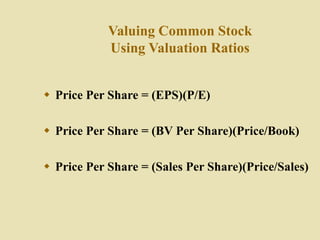

This document provides an overview of valuation methods for various financial assets including bonds, preferred stock, and common stock. It introduces the basic valuation formula that discounts future cash flows to their present value using an investor's required rate of return. For bonds, the document discusses how to determine intrinsic value and yield to maturity. For preferred stock, it covers valuation as a perpetuity. For common stock, it presents both a basic dividend discount model and a constant growth model, as well as valuation using multiples.