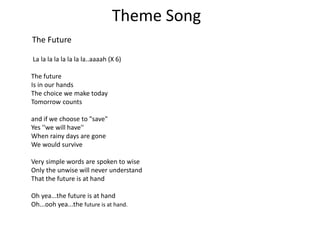

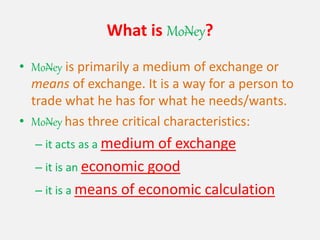

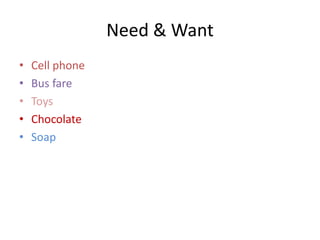

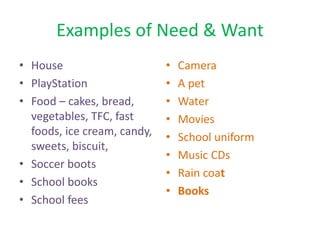

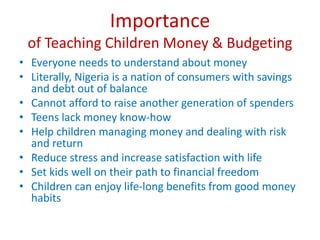

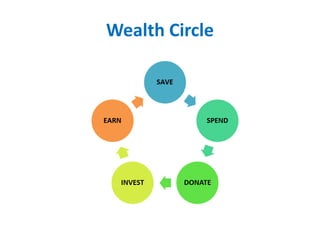

The document summarizes the proceedings of the Teach Children To Save Summit 2014. It includes performances of the national anthem and theme song. The keynote address was given by the Central Bank of Nigeria on financial literacy. Several sessions followed that taught children the differences between needs and wants, money management, and the importance of budgeting and saving through examples and activities. The concept of the "Ant Bank" was introduced to encourage saving for the future like ants store food. The document emphasizes cultivating good financial habits in children.