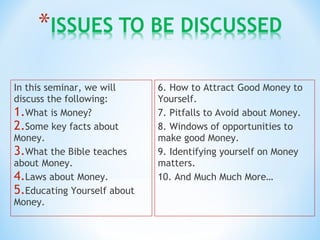

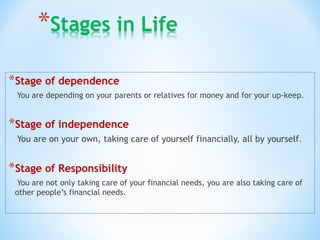

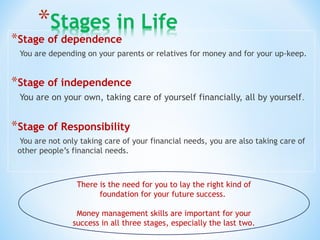

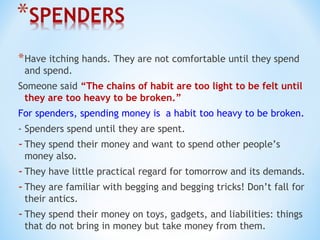

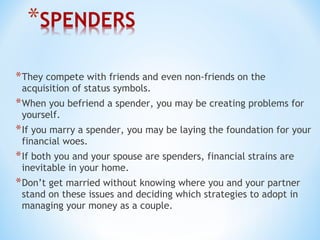

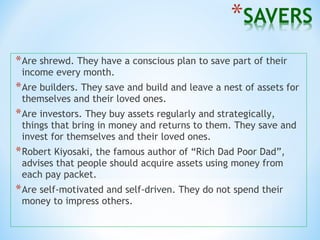

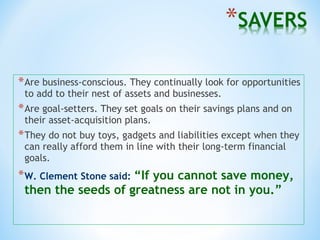

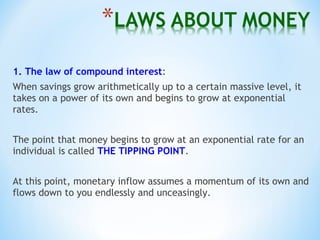

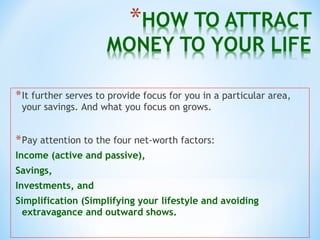

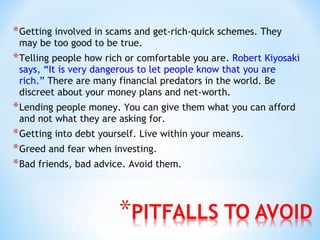

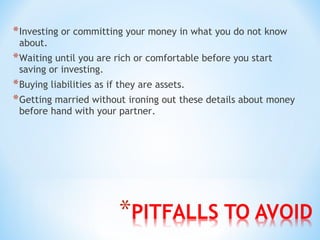

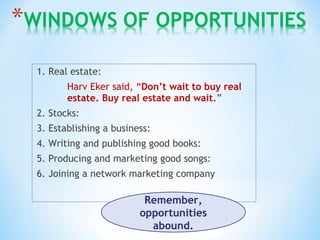

This document outlines the topics that will be discussed in a seminar on money matters. It includes definitions of money, key facts about money from the Bible and laws, educating oneself on money, attracting good money, pitfalls to avoid, opportunities to make money, identifying with money, and managing money. The seminar will discuss attitudes, mental frameworks, and stages of financial dependence, independence, and responsibility. It also provides tips for savers versus spenders and laws related to accumulating wealth through saving and investing.