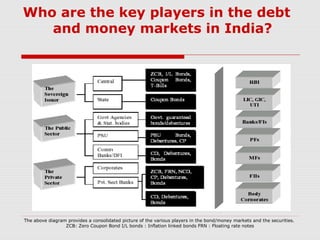

The document provides an overview of key concepts in the Indian debt and money markets. It discusses the various players and instruments in these markets such as government securities, treasury bills, commercial papers, certificates of deposit, and repos. It also explains important terms like repo rate, yield curve, yield to maturity, duration, and interest rate swaps. The presentation aims to educate investors on debt market instruments and how interest rates impact their prices and returns.

![What is the “SO” in a rating ? [AAA(SO)]

Pass Through Certificate/PTC

Structured Obligation (SO) or Structured Finance is a

term that is applied to a wide variety of debt

instruments wherein the repayment of principal

and interest is backed by: Cash flows from a pool

of financial assets and/or Credit enhancement

from a third party The process of converting

financial assets (loans, receivables, etc.) into

tradable securities is generally referred as

‘securitization’ and the securities thus created are

referred as ‘asset backed securities’ (ABS). The

Pass Through Certificates (PTCs) in our portfolios

also fall under this category](https://image.slidesharecdn.com/debtmarket-131203052933-phpapp02/85/Debt-market-31-320.jpg)