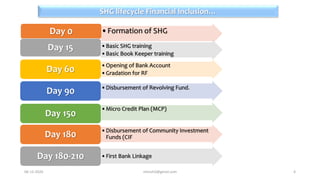

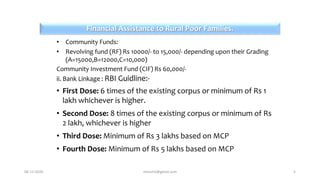

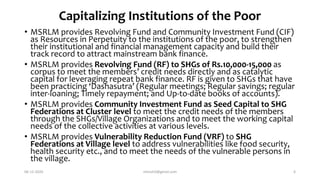

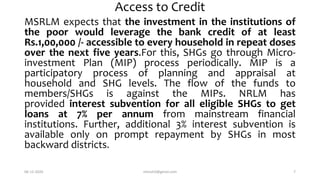

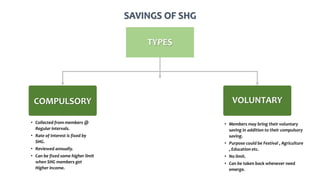

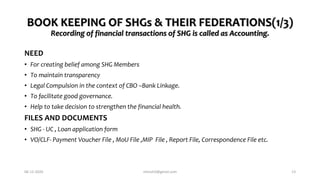

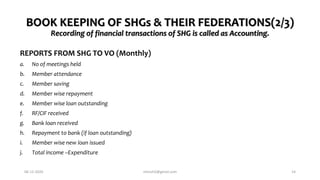

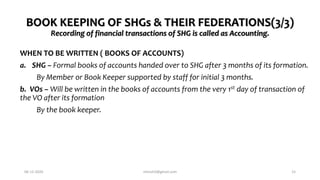

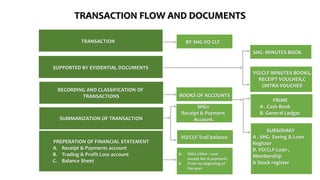

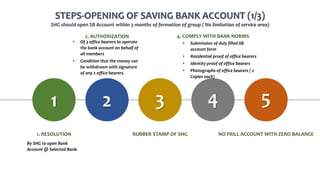

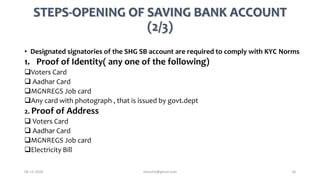

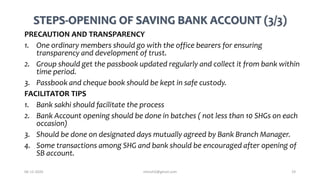

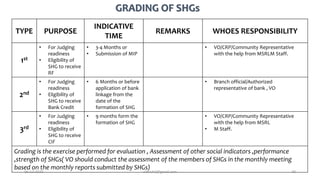

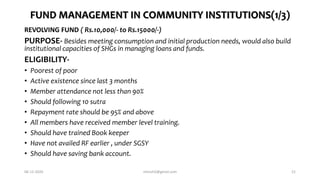

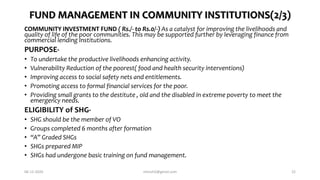

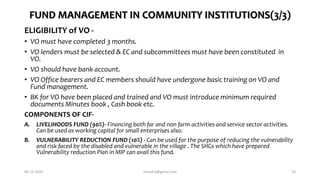

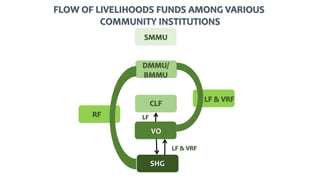

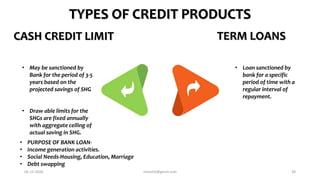

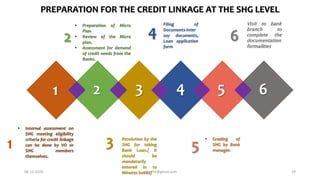

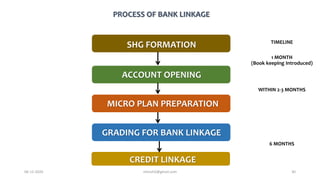

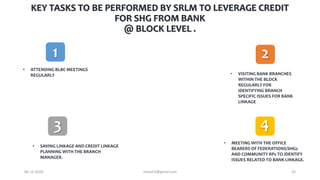

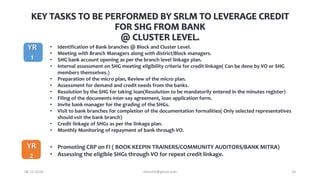

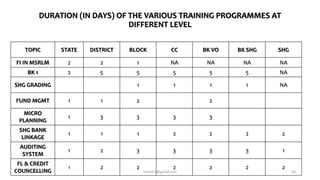

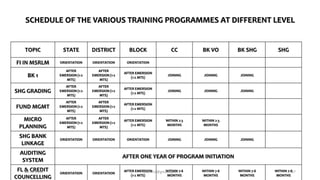

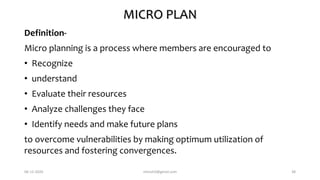

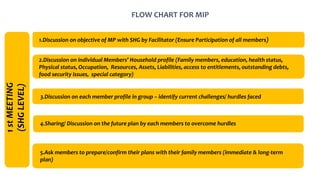

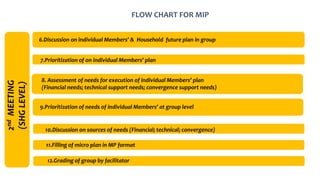

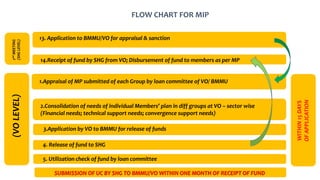

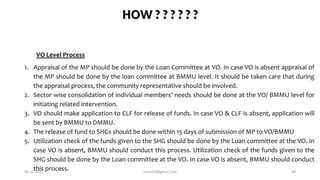

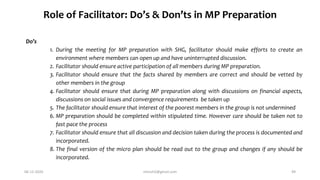

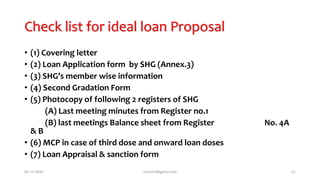

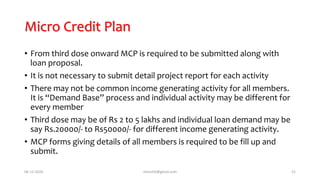

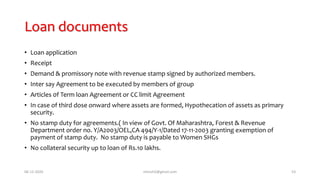

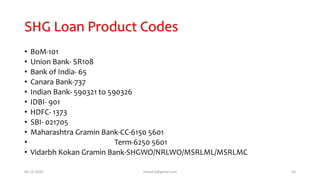

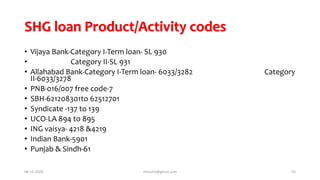

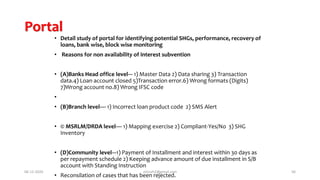

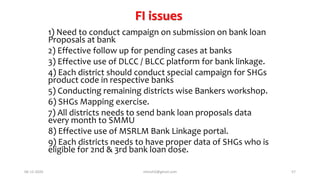

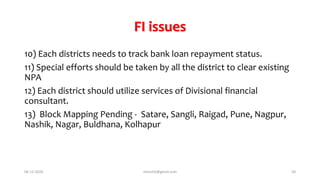

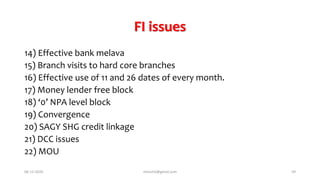

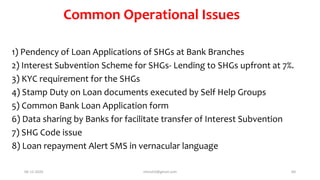

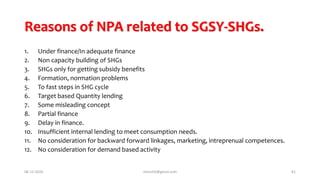

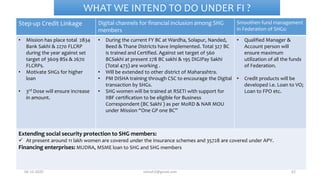

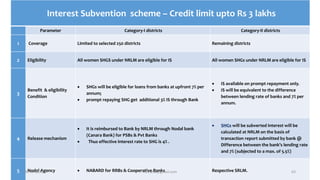

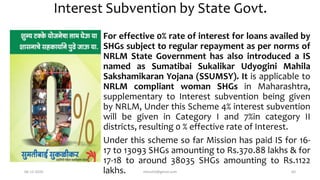

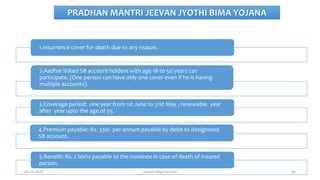

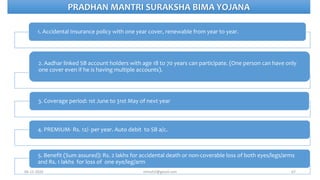

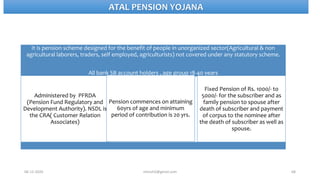

The document outlines the financial inclusion initiatives by the Maharashtra State Rural Livelihoods Mission (MSRLM) aimed at making the poor preferred clients of financial institutions through various financial services such as savings, credit, and insurance. It details the lifecycle of Self Help Groups (SHGs), including training, bank account initiation, and credit linkages, along with descriptions of community funds like the Revolving Fund and Community Investment Fund. The focus is on improving access to affordable financial services, supporting livelihoods, and enhancing the financial management capabilities of the rural poor.