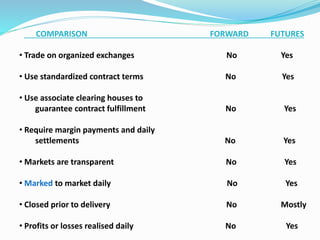

Derivatives are financial instruments whose value is based on an underlying asset. A derivative contract derives its value from changes in the price of the underlying asset. There are three main types of derivatives - forwards, futures, and options. Forwards are customized contracts where two parties agree to buy or sell an asset at a future date at a predetermined price. Futures are standardized forward contracts that are traded on an organized exchange. Options contracts give the holder the right but not the obligation to buy or sell the underlying asset at a predetermined price on or before a specified date in the future.