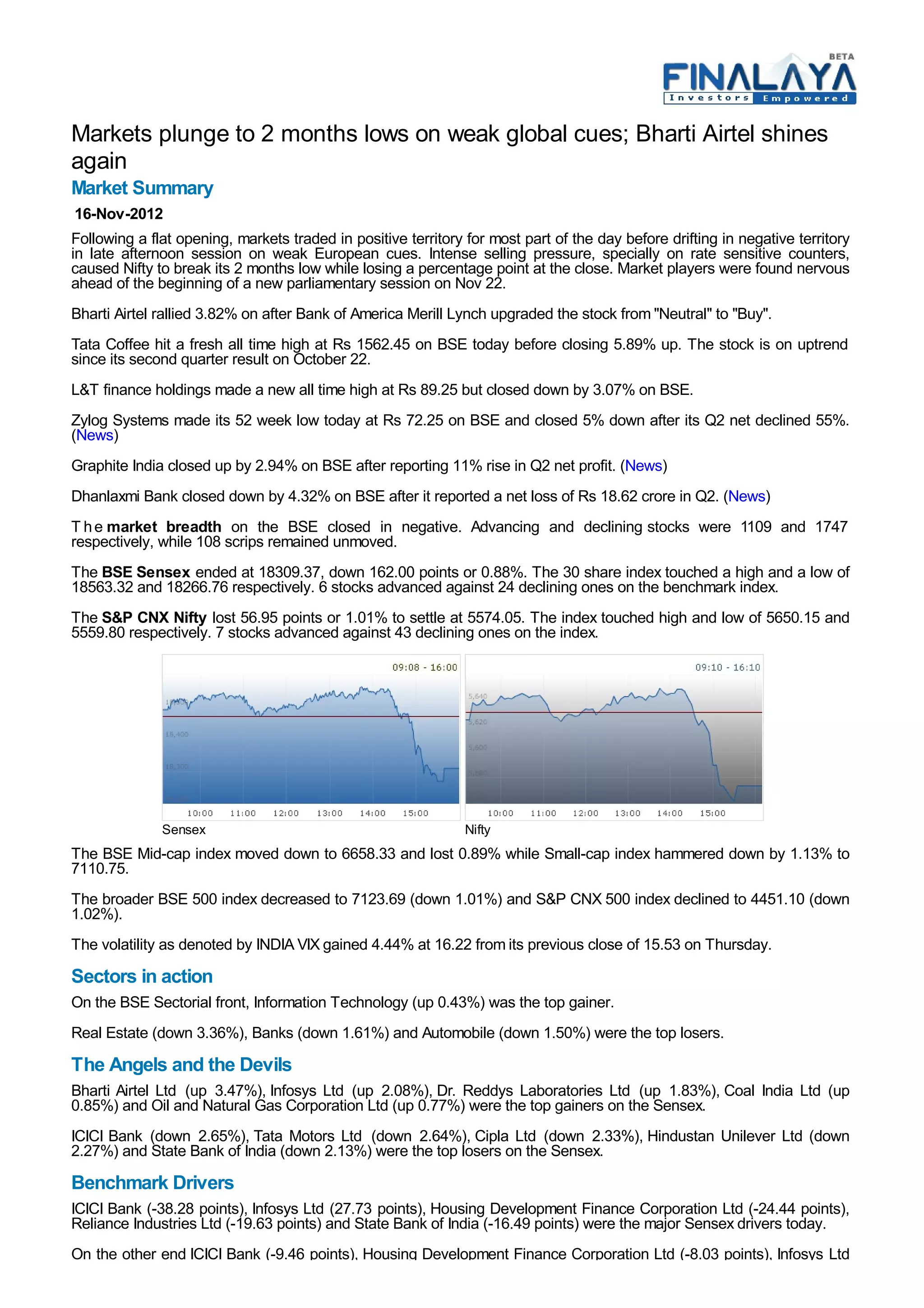

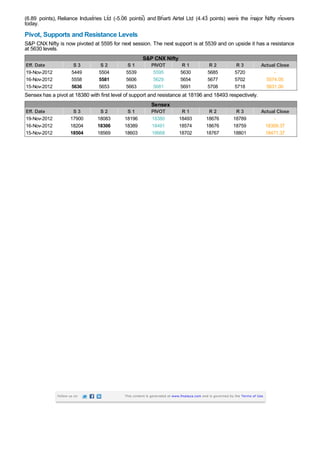

On November 16, 2012, markets fell to two-month lows due to weak global signals, with the Nifty index losing 1.01% and the Sensex down 0.88%. Bharti Airtel's stock increased by 3.82% after a rating upgrade, while several other stocks, including Tata Coffee and L&T Finance, experienced notable volatility. The broader market showed negative breadth, with declining stocks outnumbering advancers significantly.