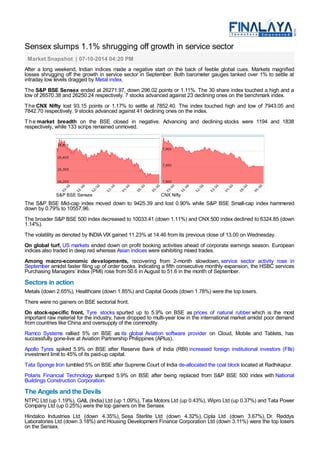

Indian stock indices declined over 1% due to weak global cues and losses in metal stocks. The Sensex closed down 296 points at 26,272 and the Nifty fell 93 points to 7,852. Metal and healthcare sectors saw the biggest losses, while higher rubber prices boosted tyre companies. Most Asian markets traded mixedly in response to profit taking on Wall Street ahead of earnings season.