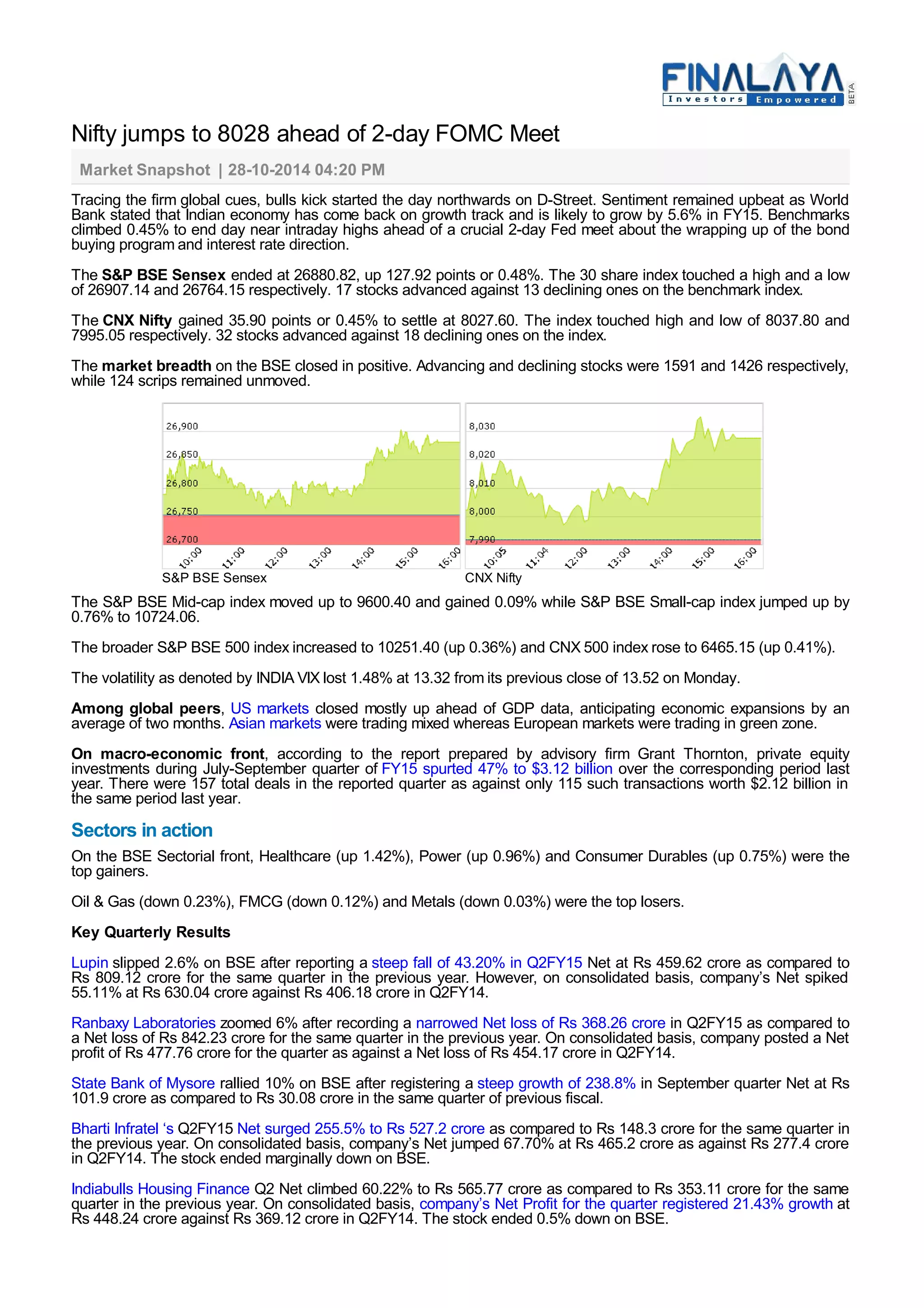

The Indian stock market experienced positive movement, with the CNX Nifty climbing to 8027.60, spurred by optimistic global cues and a report predicting 5.6% economic growth for India. Notable sector gains included healthcare and power, while some major companies reported mixed quarterly results, with significant profit increases from firms like State Bank of Mysore and Bharti Infratel. The market breadth remained favorable, reflecting a higher number of advancing stocks compared to decliners.