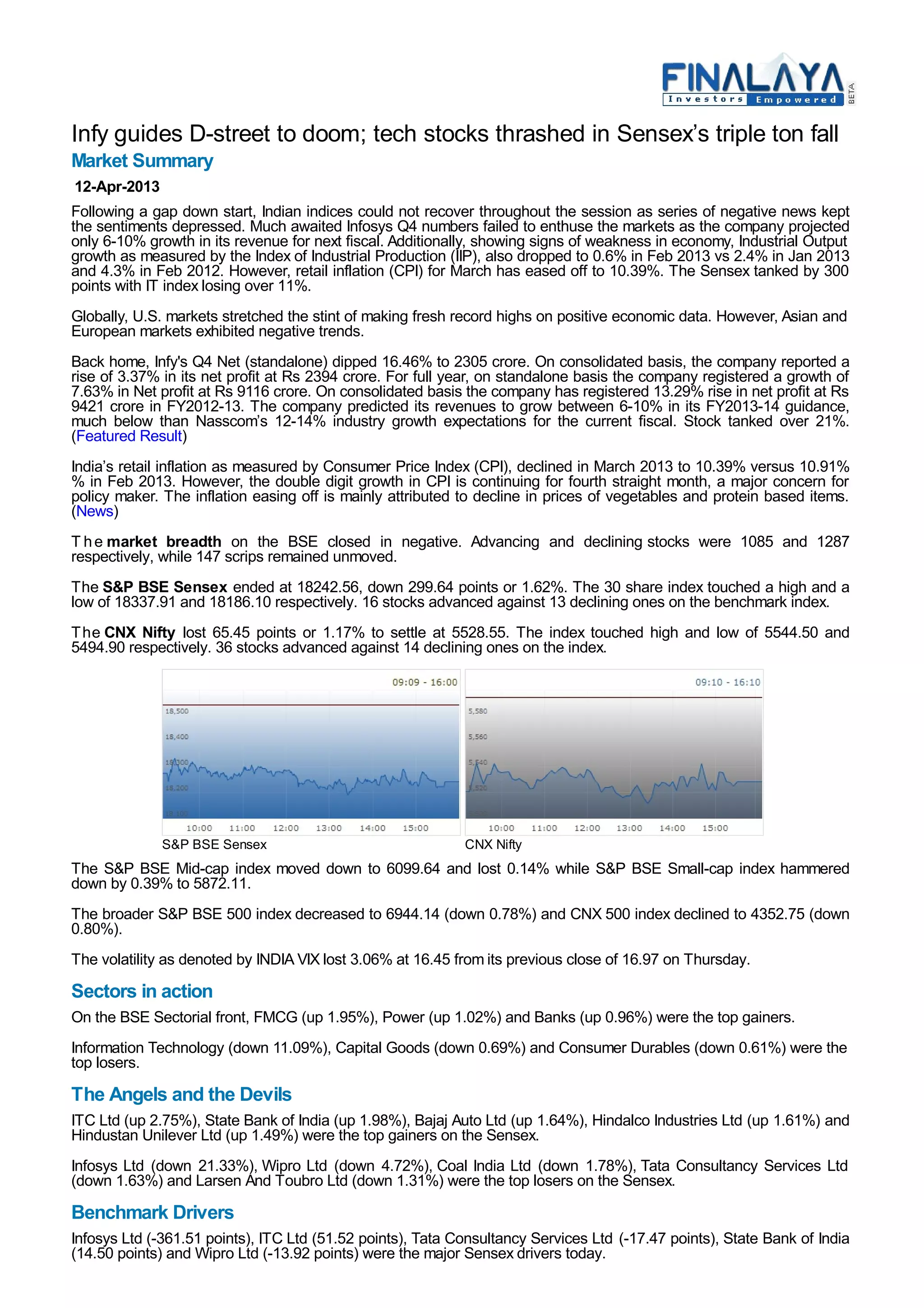

Indian stock markets experienced significant declines, with the Sensex falling by 300 points following underwhelming Q4 results from Infosys, which projected a revenue growth of only 6-10% for the upcoming fiscal year. Industrial output also showed weakness, dropping to 0.6% in February 2013, while retail inflation eased slightly to 10.39%. The overall market sentiment remained negative, as the technology sector was particularly hard-hit, leading to widespread losses among tech stocks.