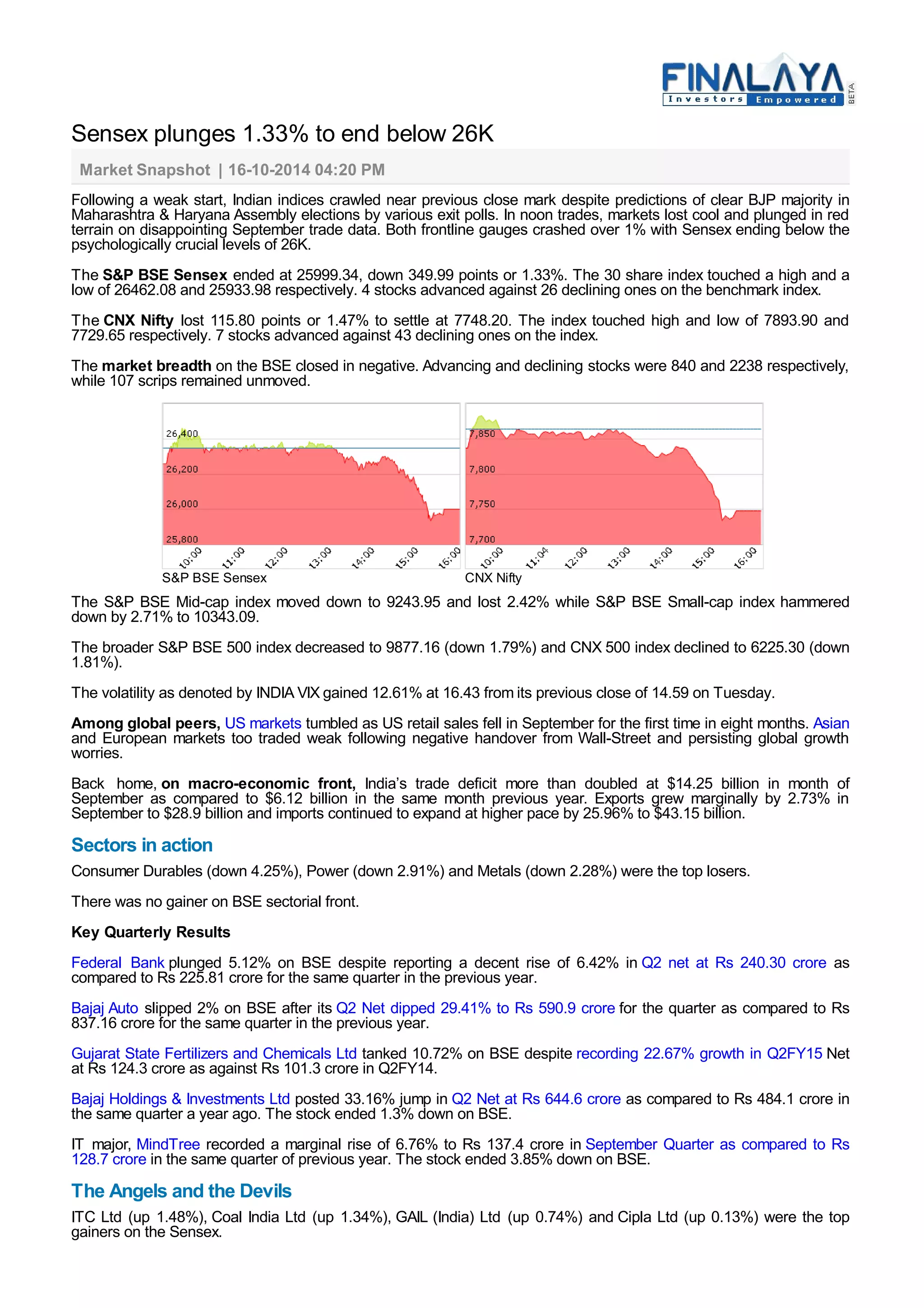

- The Sensex and Nifty indices in India fell over 1% due to disappointing trade deficit data and weak global cues. The Sensex closed below 26,000 points.

- India's trade deficit more than doubled in September compared to the same period last year as exports grew marginally while imports expanded at a higher pace.

- Most sectors declined with consumer durables, power, and metals being the top losers. Key companies like Hindalco, M&M, and Tata Steel were among the top losers on the Sensex.