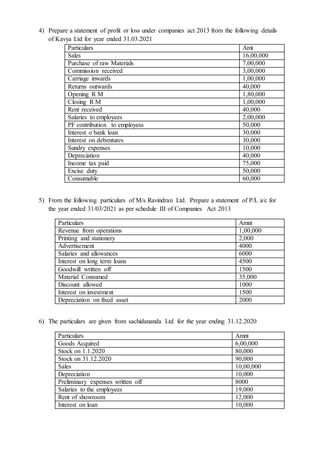

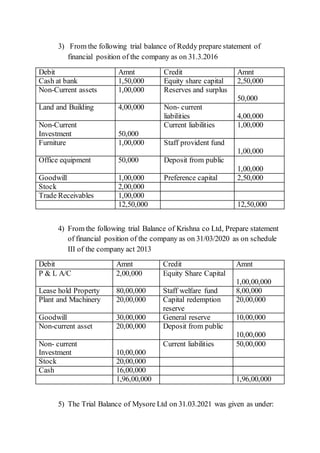

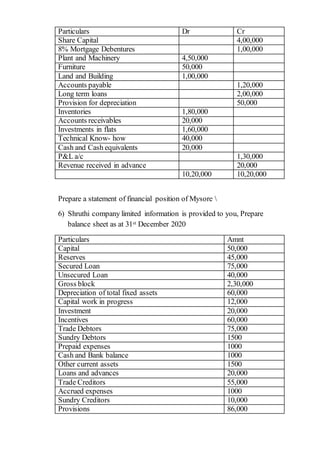

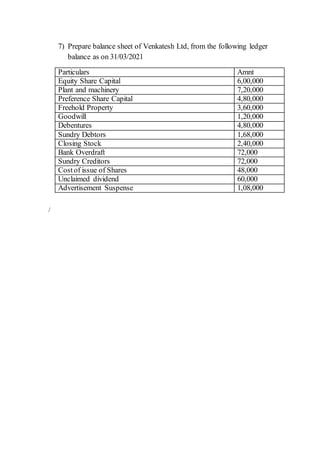

From the information provided, statements of profit and loss and financial position can be prepared for several companies as follows:

1) The document provides details of revenues, expenses, assets and liabilities for multiple companies including Shankar Ltd, XYZ Co, Ravindran Ltd, Kavya Ltd, Sachidananda Ltd, MN Co Ltd, Reddy, Krishna Co Ltd, Mysore Ltd and Venkatesh Ltd.

2) Financial information includes items like revenues, costs, assets, liabilities, equity, reserves and retained earnings.

3) From the details provided, statements of profit and loss and financial position can be prepared for the years ending 2020-2021 for each company according