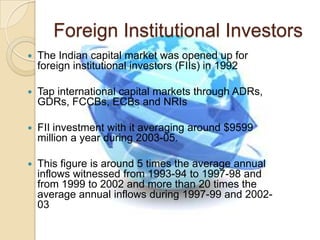

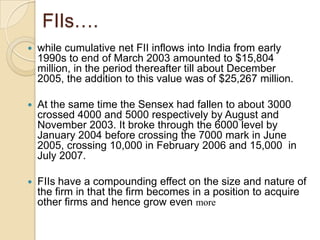

Foreign institutional investors (FIIs) play an important role in the development of the Indian economy. FIIs invest large amounts of capital in Indian stock markets, which enhances equity capital flows and financial development. However, large FII inflows can also lead to inflation, currency appreciation that hurts exports, and volatility from "hot money" that moves in and out of the country quickly. While FIIs have improved stock market infrastructure and corporate governance, they also have significant influence over stock prices that can disadvantage small retail investors. Regulations have been established to manage FII investment in India.