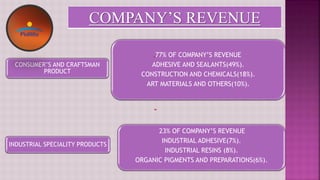

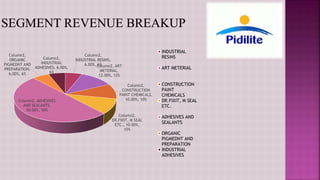

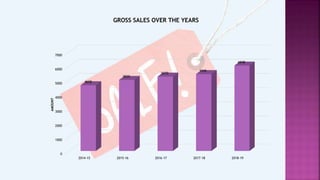

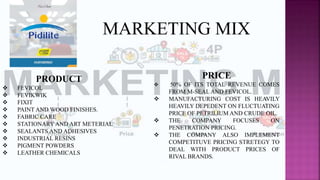

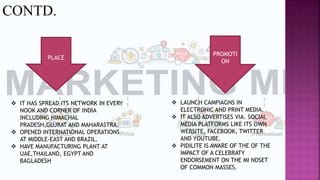

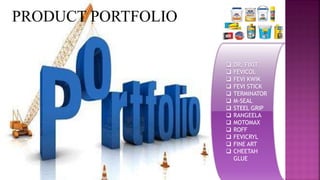

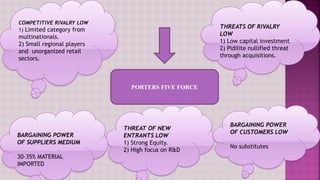

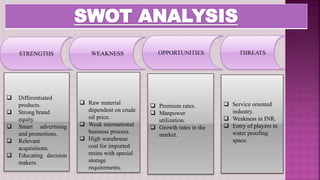

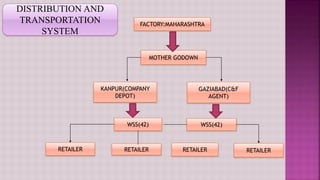

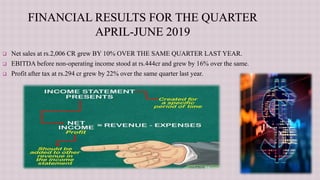

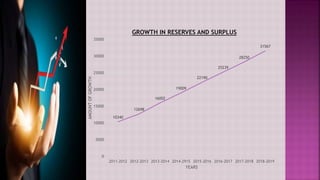

The document provides information about Pidilite Industries Limited, an Indian adhesive manufacturing company. It discusses that the company was founded in 1959 in Mumbai and currently has over 5,500 employees. It earns total annual revenue of over $730 million. The document then gives details about the company's product portfolio, market share, distribution network, strategies and financial growth over the years.