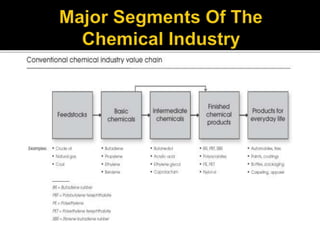

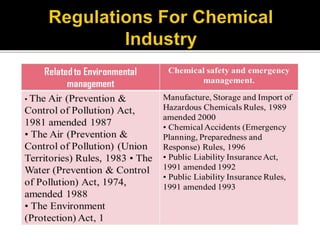

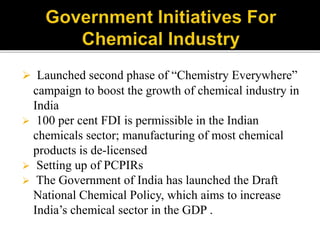

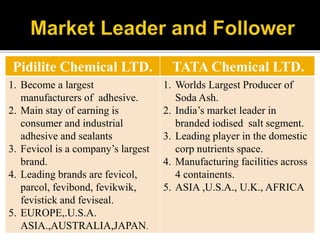

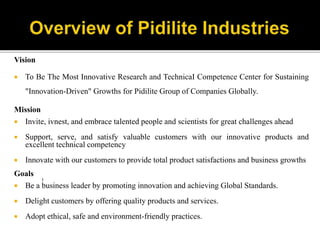

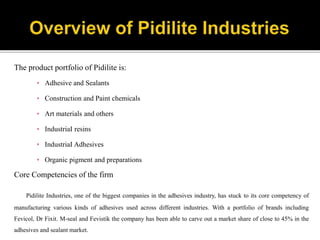

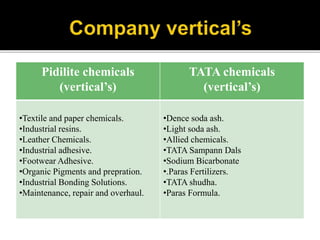

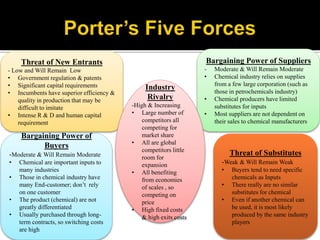

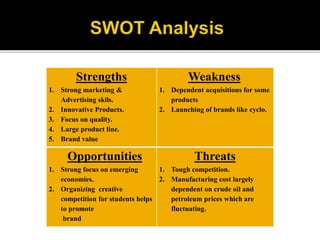

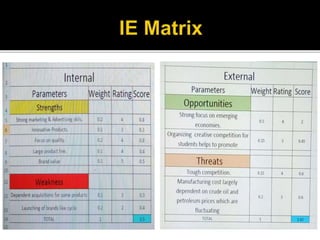

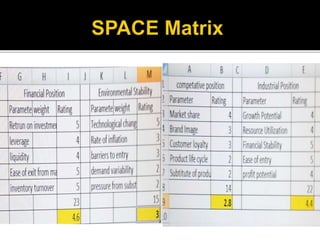

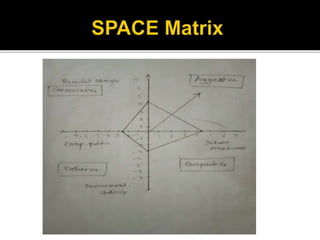

This document provides an overview of the chemical industry in India and an analysis of Pidilite Industries Ltd., a leading manufacturer and marketer of adhesives, sealants and construction chemicals in India. The document begins with listing group members for a project. It then provides sections on the introduction to the chemical industry, key segments, regulations, government initiatives, top players, and an overview of Pidilite Industries. For Pidilite and Tata Chemicals, it describes their main business segments and brands. The document also includes analyses of Pidilite using PESTEL, Porter's Five Forces, SWOT, IE Matrix, SPACE matrix. It concludes with key points about Pidilite's customer