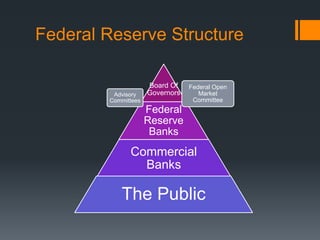

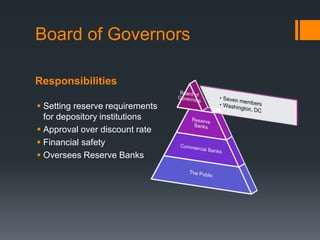

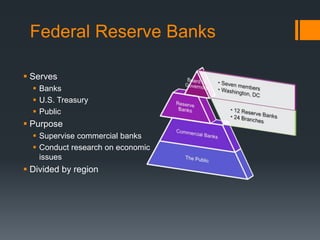

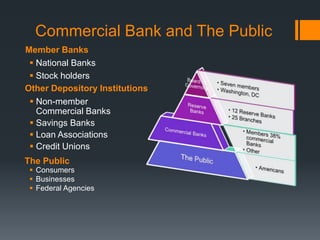

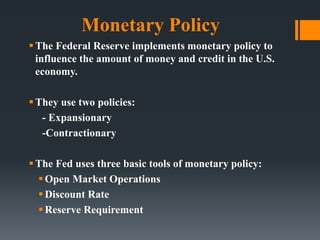

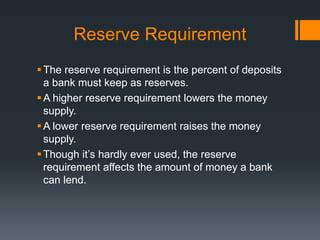

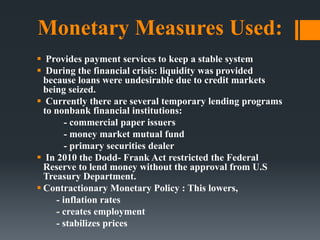

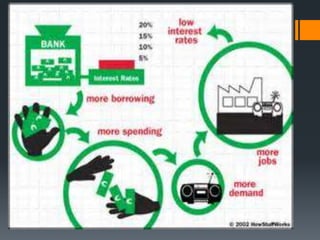

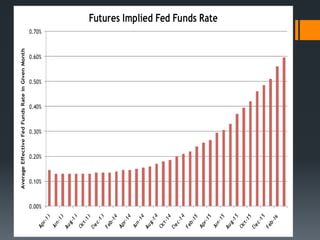

The Federal Reserve is the central bank of the United States whose structure includes the Board of Governors, 12 regional Federal Reserve Banks, and advisory committees. It implements monetary policy to influence money supply and credit conditions through tools like open market operations, reserve requirements, and the discount rate. The Federal Reserve also provides banking services to depository institutions, the U.S. government, and foreign official institutions. Its goals include maximizing employment, stabilizing prices, and moderating long-term interest rates.