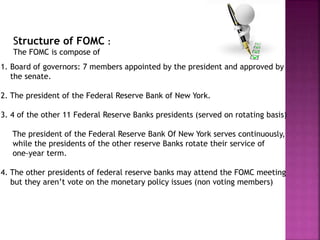

The FOMC determines monetary policy for the United States. It is composed of the Board of Governors of the Federal Reserve System and the presidents of the 12 Federal Reserve Banks. The FOMC meets regularly to set short-term interest rates and decide other economic policies based on reports on employment, inflation, and growth. It seeks to promote maximum employment and stable prices. In its most recent meeting, the FOMC voted to maintain near-zero interest rates given moderate economic expansion and below-target inflation.