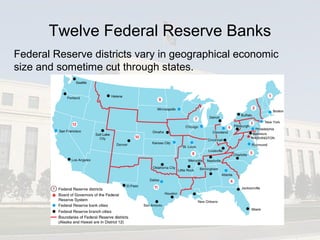

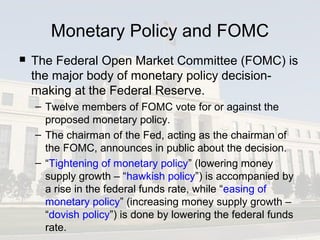

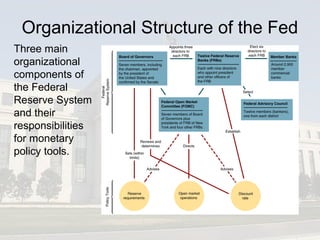

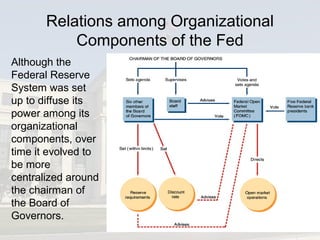

The Federal Reserve System is the central bank of the United States, consisting of 12 regional Federal Reserve Banks overseen by a Board of Governors. It was established in 1913 to conduct monetary policy and regulate banking. The Federal Reserve pursues goals of maximum employment, stable prices, and moderate long-term interest rates through tools like open market operations and interest rate targets. It aims to maintain independence from political pressure to ensure decisions are made in the best economic interests of the country.