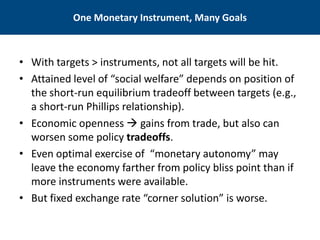

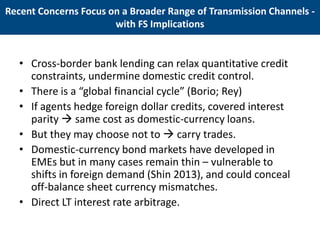

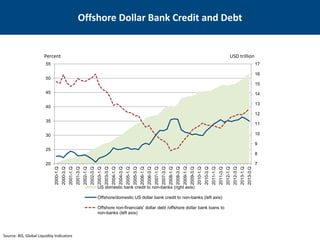

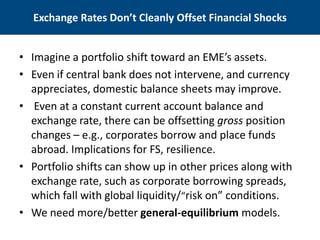

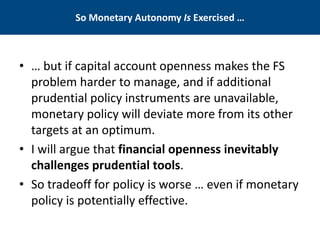

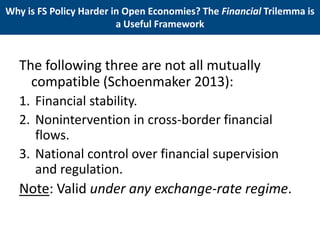

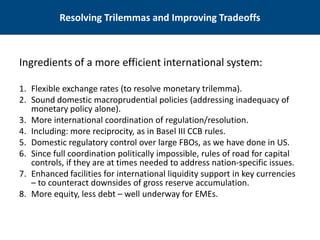

The document discusses the conflicting perspectives on monetary autonomy in small open economies, focusing on the challenges posed by global financial integration and capital flows. It outlines the classic monetary trilemma and introduces the financial trilemma, emphasizing the difficulties of maintaining financial stability while managing cross-border financial interactions. The paper argues for a framework that includes flexible exchange rates, robust domestic macroprudential policies, and enhanced international regulatory coordination to improve policy trade-offs and address emerging financial stability issues.