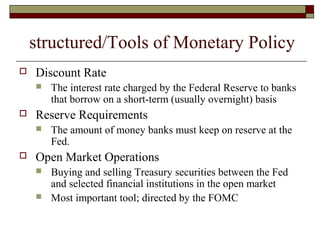

The Federal Reserve system was established in 1913 to serve as the central bank of the United States. It aims to ensure price stability and moderate long-term interest rates. The Fed is composed of the Board of Governors, 12 regional Federal Reserve Banks, and the Federal Open Market Committee. The FOMC sets monetary policy by adjusting interest rates and the money supply through open market operations. The Fed oversees banking institutions, maintains the stability of the financial system, and provides various central banking services.