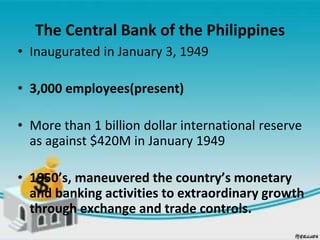

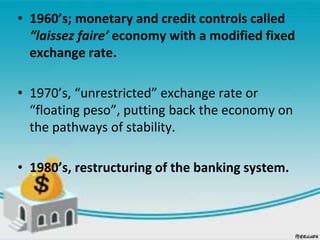

The document discusses the central bank's role in regulating monetary and credit conditions to promote economic growth and stability. It outlines the central bank's objectives, functions, tools, and historical context, emphasizing its independence from political influences and its responsibility as a fiscal agent, reserve manager, and monetary regulator. The evolution of the Central Bank of the Philippines is also highlighted, detailing its growth and adaptation of monetary policies over the decades.