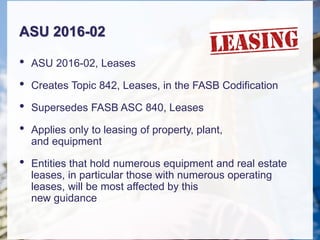

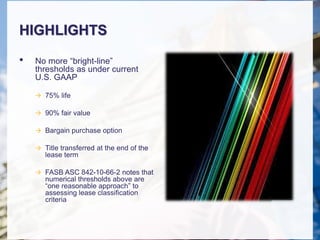

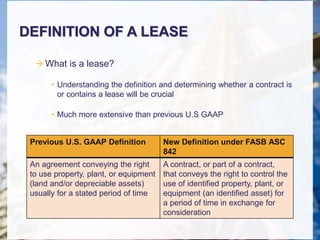

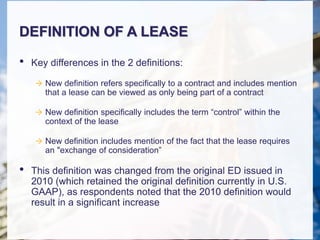

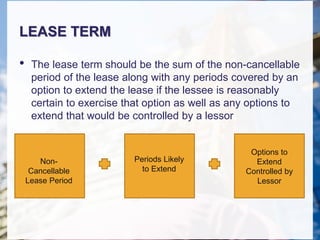

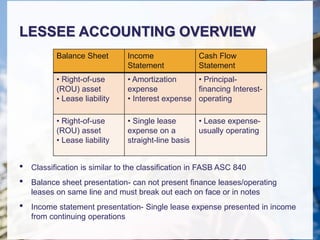

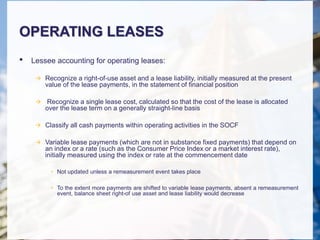

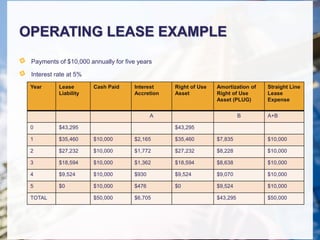

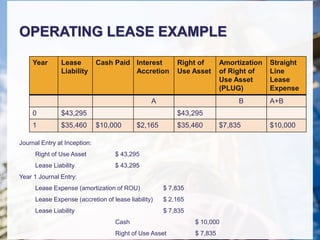

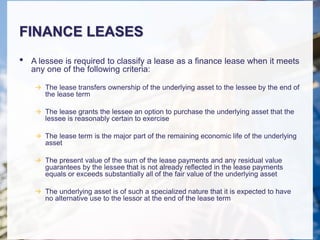

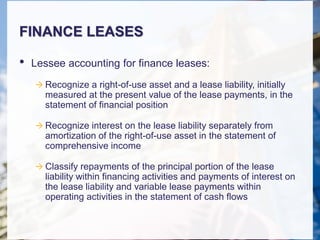

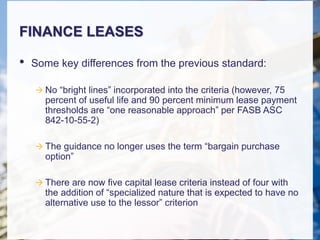

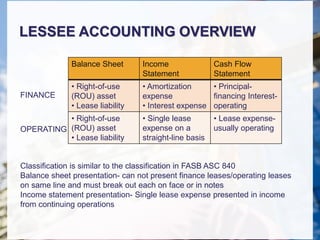

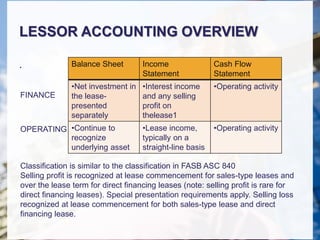

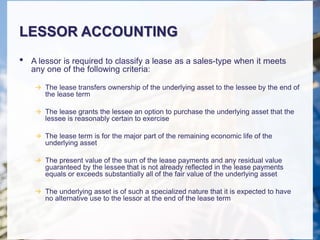

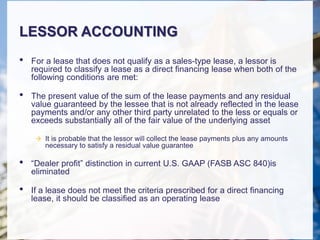

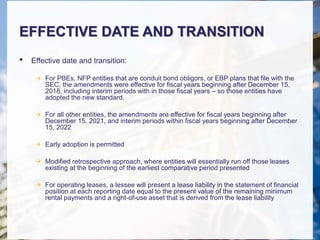

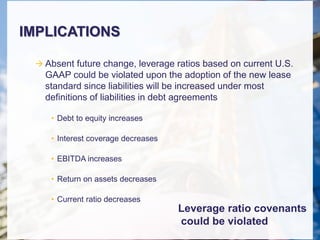

The document outlines ASU 2016-02 regarding leases, introducing Topic 842 which updates the definition of leases and accounting requirements for lessees and lessors. Key changes include the recognition of operating leases as assets and liabilities on balance sheets, the elimination of 'bright-line' thresholds for lease classification, and new criteria for finance leases. The guidance also addresses related party leases and has significant implications for lease versus buy decisions and accounting processes.