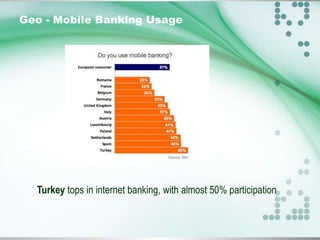

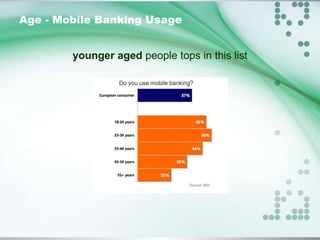

The document discusses mobile banking trends in 2014, highlighting the impact of innovative technology on real-time banking access and customer loyalty. It emphasizes the growing importance of digital wallets, mobile payment applications, and advanced authentication methods like biometrics. The analysis indicates that banks are increasingly investing in mobile solutions to maintain a competitive advantage in an evolving environment.